Articles Menu

November 14, 2018

Investors have gone from contemplating the prospect of oil at $100 to sub-$50 in less than two months. No wonder global markets are playing catch-up.

Here’s a look at the cross-asset fallout:

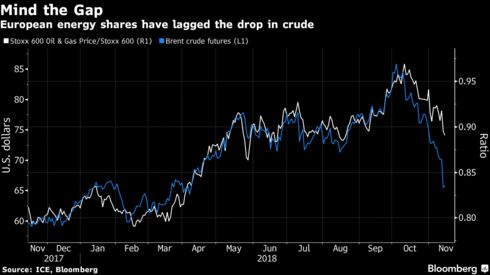

The Stoxx Europe 600 Index dropped on Wednesday, with oil and gas companies among the big losers. There could be more pain in store. The performance of energy shares relative to the broader index has yet to hit year-to-date lows despite elevated price swings in the oil-market complex.

In the U.S., energy stocks were the biggest drag on the S&P 500 Index on Tuesday as the benchmark gauge reversed a gain of more than 1 percent to finish in the red. The jump in volatility of the oil price will feed into already bruised U.S. stocks, according to Macro Risk Advisors.

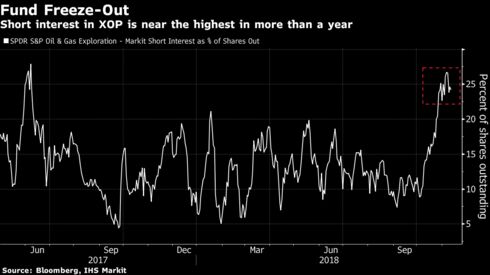

About $80 million flowed out of the SPDR S&P Oil and Gas Exploration and Production exchange-traded fund, ticker XOP, on Tuesday. That was the third day of withdrawals and the largest in more than two weeks.

Short interest in XOP is at its highest in more than a year, with nearly a quarter of shares outstanding lent out. The ETF tracks an equal-weighted basket of U.S. oil and gas firms.

Read more on how the oil slump broadsided equity markets.

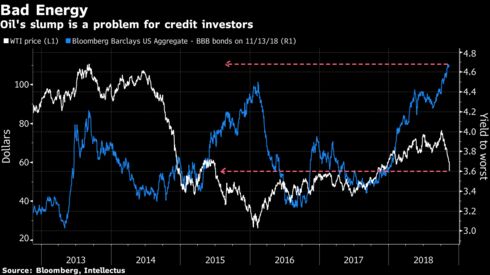

The corporate bond market had taken the slide in crude on the chin but Tuesday’s rout may force investors to pay closer attention.

U.S. investment-grade debt was already facing the worst year since 2008, and energy securities make up some 15 percent of the BBB rated universe.

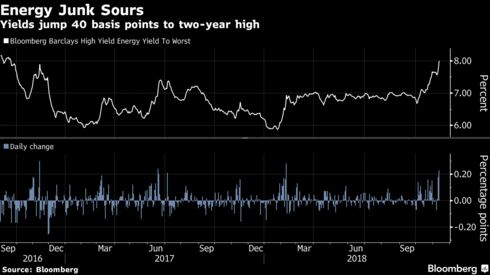

The energy sector also accounts for about 15 percent of the entire U.S. high-yield bond index -- that gauge posted the biggest drop in six weeks on Tuesday. Yields on sub-investment grade debt in the sector have surged since the start of October.

However, as Ye Xie of Bloomberg’s Markets Live blog notes, a regression of oil prices and the high-yield credit spread since 2010 shows that WTI between $50 and $70 looks like a sweet spot for junk bonds. The spread tends to widen below $45, his analysis shows.

Read more on how the decline in oil plays into credit markets.

Meanwhile, tumbling prices are undercutting market gauges of headline inflation expectations in Germany and the U.S., close to notching 2018 lows. Any slowdown in price growth could mean a less hawkish outlook for monetary policy.

Declining oil is a two-sided coin for the collection of assets and economies classed as emerging markets. Many of the countries, such as Gulf nations like Saudi Arabia, are energy exporters that suffer when prices decline. Others, like Turkey and India, have to import fuels and so benefit from cheaper energy.

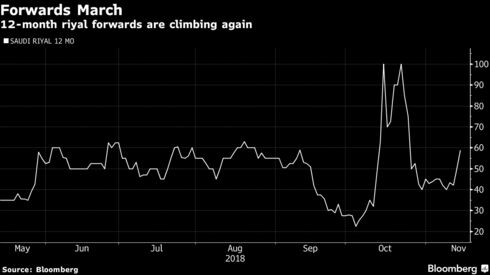

After a torrid few months, India’s rupee rallied to the highest in almost two months on Wednesday. Forwards for the Saudi riyal jumped for the second time in a month, indicating traders are betting the currency -- which is pegged to the dollar but trades in a narrow range -- is set to weaken.

Still, the link between oil and currencies is far from straightforward, with Russia’s ruble defying the latest downdraft. In fact, the historic relationship between exchange rates of some of the world’s biggest crude exporters and oil prices has been gradually breaking over the past year.

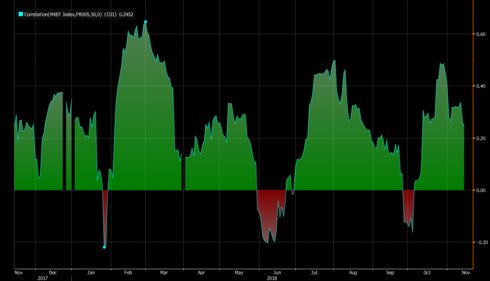

Commodity currencies are getting less correlated with oil

Chart shows 90-day correlation with WTI crude

The impact for other emerging assets may have more to do with the signals oil is sending on global growth. If price declines are driven by shifts in demand, it suggests a slowdown -- bad news for developing nations. If the slide is based on increasing supply, the consequences for EM are less clear-cut.

Unfortunately for investors, in the current rout it’s a bit of both. No wonder the correlation between oil prices and the MSCI Emerging Market Index of stocks varies wildly.

Correlation between emerging-market stocks and Brent.

Read more on how emerging markets are reacting to the oil collapse.

— With assistance by Sid Verma, Sarah Wells, Ye Xie, Yakob Peterseil, Luke Kawa, Natasha Doff, and Cormac Mullen