Articles Menu

Mar. 30, 2022

Canada’s new climate plan is banking on carbon capture to cut nearly 13 per cent of the oil and gas sector’s projected greenhouse gas emissions by 2030. But a new report reveals billions of public dollars already spent on the technology aren’t yielding substantial reductions.

“It's not at all realistic,” said Julia Levin, senior program manager at Environmental Defence and author of the report. “Globally, this is not a new technology. This is technology that's been around for 30 years, (with) billions of dollars going into (it) and we're still only capturing less than 40 megatonnes … that's 0.001 per cent of our global emissions.”

Carbon capture utilization and storage (CCUS) projects only capture 0.05 per cent of Canada’s greenhouse gas emissions, or around 3.55 million tonnes of carbon per year, according to the new report, published March 31 by Environmental Defence.

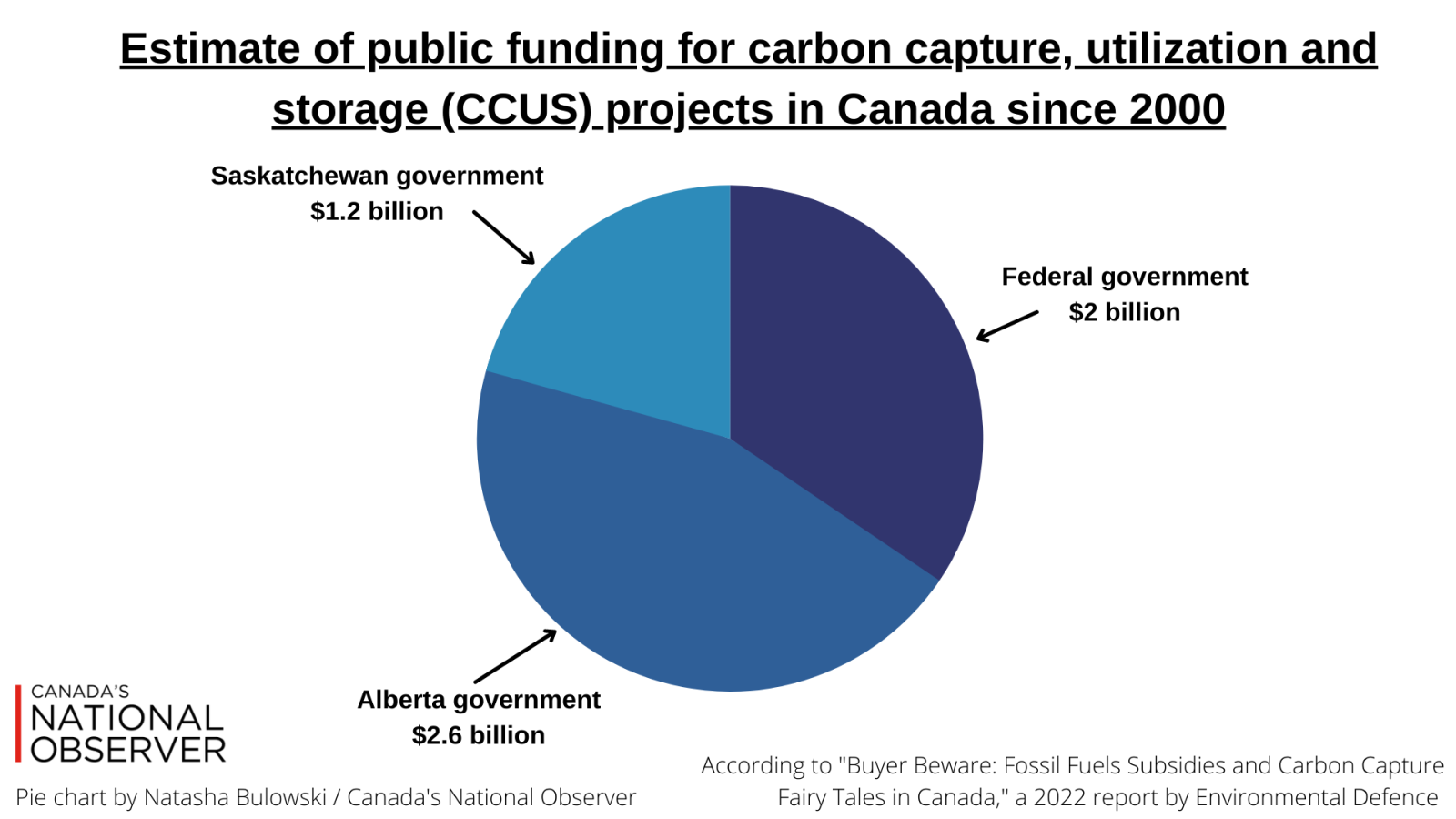

The report provides the first estimate of public funding for CCUS projects in Canada. It found federal and provincial governments have provided approximately $5.8 billion since 2000, and this number stands to grow in the soon-to-be-announced federal budget.

Just last fall, Natural Resources Minister Jonathan Wilkinson told The Canadian Press that "at this stage in Canada, CCS technology has not reached the level of commercial maturity nor cost maturity that is likely going to be a solution before 2030.”

“They have said publicly on multiple occasions ‘it's not part of our 2030 toolkit,’ and they've now released a plan that says the opposite,” said Levin. The climate plan includes the federal government’s proposed investment tax credit for CCUS, which will be designed to reduce emissions by at least 15 million tonnes per year, with more details appearing in the April 7 federal budget.

More than 400 academics, 500 organizations and 30,000 Canadians oppose the proposed tax credit and warn it will lock in oil and gas production and amount to a new fossil fuel subsidy.

Bloc Québécois, NDP and Green politicians are also critical of the proposed tax credit and new climate plan.

CCUS involves trapping carbon dioxide released during industrial processes to prevent it from being emitted into the atmosphere, where it contributes to global warming. Once captured, carbon dioxide can be stored indefinitely underground or transported through pipes for different industrial uses — most often to extract more oil.

“For Canada to ignore what the science is saying and double down on a risky technology is gambling with all of our lives,” said @lev_jf about the #EmissionsReductionPlan's reliance on carbon capture to slash emissions in the oil & gas sector #cdnpoli - Twitter

This is the case with 70 per cent of captured carbon in Canada, resulting in increased oil production, the report says. Opponents of the tax credit stress that even if emissions from the production and refining of oil could be brought to zero, 80 per cent of the oil and gas sector’s pollution comes when its product is ultimately burned, and there is still no way to trap the carbon that comes out of a tailpipe.

The report also notes carbon capture rates aren’t always what they seem. Shell’s Alberta-based Quest CCUS project has a capture rate of 80 per cent, but a recent report by Global Witness found the facility — which produces blue hydrogen — actually emits more carbon than it captures. It found only 48 per cent of the plant’s carbon emissions are captured, with that number falling to 39 per cent when other greenhouse gas emissions from Shell’s project are included.

The emissions reduction plan also says 10 per cent of the oil and gas sector’s reductions will come from hydrogen, which means we’ll have to rely even more on carbon capture, said Levin.

This is because Canada's hydrogen strategy centres on blue hydrogen, which is produced from natural gas with carbon capture, as opposed to green hydrogen, which is made with renewable electricity, or grey hydrogen, which is made from natural gas with no carbon capture. A meeting note obtained by Canada’s National Observer through a federal access-to-information request revealed the Liberal government intends to use existing infrastructure and grey hydrogen production to “kick-start Canada’s hydrogen economy” in the short term.

This is why over 400 academics wrote to Finance Minister Chrystia Freeland urging her to scrap the proposed CCUS tax credit or at least limit it to sectors with no decarbonization options, such as cement, and exclude any fossil fuel, plastics or petrochemical production.

“For Canada to ignore what the science is saying and double down on a risky technology is gambling with all of our lives,” said Levin.

Between 2018 and 2020, Canada provided 14 times more public finance to fossil fuels than renewables, according to a 2021 study by Oil Change International and Friends of the Earth U.S.

“At a time when the oil and gas industry is flush with cash, if they want to take bets that they can meet their mission targets with CCS, let them pay for it,” said Levin, also noting the emissions reduction plan urges the sector to use its profits to reduce emissions. “But we should definitely not be using taxpayer dollars and we also shouldn't be baking it into our climate plans.”

The federal government’s promised cap on oil and gas emissions is still being discussed, but Levin says it needs to be “way more ambitious” than the 31 per cent reduction under 2005 levels by 2030 outlined in the emissions reduction plan.

“Then, oil and gas companies can figure out how to reach that target. If they can't do it through CCS, then they're going to have to ramp down production,” she said. “And we know that's what needs to happen.”

— With files from John Woodside

[Top photo: A new report reveals billions of public dollars already spent on carbon capture technology are only reducing 0.05 per cent of Canada's annual emissions. Photo by JuniperPhoton / Unsplash]