Articles Menu

Sept. 7, 2022

Deep under the choppy waters off Newfoundland and Labrador’s coast lies the key to the province's financial future: billions of barrels of oil it hopes will be extracted over the coming years.

That's how Newfoundland and Labrador is framing its latest push into offshore drilling, anchored by the recent federal approval of Bay du Nord. That project, if built, will become Canada’s first deepwater oil site, emitting 30 million tonnes of carbon dioxide pollution annually. Now, Newfoundland and Labrador hopes to attract more projects like it, inviting the world’s oil majors to further explore the area off its coast and add more oil production to the economically struggling province’s balance sheet — all part of a plan to double offshore oil production by the end of the decade.

“From the perspective of the provincial government, Bay du Nord is the next step in what's going to be an even wider opening up of the offshore,” said Angela Carter, a University of Waterloo politics professor based in Newfoundland and author of Fossilized: Environmental Policy in Canada's Petro-Provinces. “This is about a commitment to expand the offshore to an unprecedented level.”

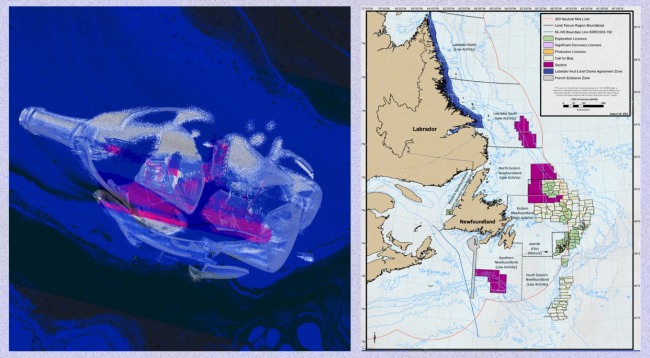

To understand the scope of this expansion, Canada’s National Observer has mapped all oil exploration, production and significant discovery licences as well as areas where companies have been invited to bid on projects this year. It also shows where exploration wells have been drilled in the past.

View the full-screen version of this interactive map by Esri Canada

The map is interactive, so you can click on an area to find information about who owns each licence, financial information, and more. Using the legend, you can click on the layers, toggling them on or off to help navigate the map. Active oil production and significant discoveries are labelled. All information included on the map was provided by the Canada Newfoundland and Labrador Offshore Petroleum Board (CNLOPB), a joint provincial-federal regulator that oversees the province’s offshore oil and gas industry.

Active production licences (in red) show sites that are currently extracting oil. In yellow are what’s called “significant discovery licences”: parcels where companies have found notable oil reserves but aren't extracting, at least yet. Exploration licences (in blue) are parcels companies have been awarded the right to explore and come with commitments to spend a certain amount by a certain date. The black dots show where wells have been drilled to look for oil. In purple are the parcels the regulator has open for bidding but that are not yet owned by any company. The red star shows where Bay du Nord is located (although it's worth mentioning, its owner, Equinor, owns several nearby parcels it collectively refers to as the Bay du Nord project).

The map reveals clusters of investment activity. Around producing oilfields like Hibernia and Hebron (shown in red on the map) are other significant discoveries in a region called the Jeanne d’Arc Basin on the Grand Banks of Newfoundland — an area historically important to the province’s fishing industry.

Newfoundland and Labrador is betting its financial future on the hundreds of millions of barrels of oil buried off its coast. Here's what that looks like. #NLpoli

Bay du Nord (where the red star is) is farther to the northeast and represents a new play for oil in an area called the Flemish Pass. The map shows other significant discoveries in the Flemish Pass, called Mizzen, Harpoon and Baccalieu — all majority-owned by Equinor. Those other discoveries helped Equinor decide to proceed with the Bay du Nord project because the company can redesign its plans to tap those other wells, adding hundreds of millions of barrels to the project’s business case.

The regulator’s call for bids also shows plans to expand further into the Flemish Pass, as well as a whole new region to the island’s southeast. The province says its oil and gas reserves span an area larger than the Gulf of Mexico.

Andrew Parsons, the province's minister of industry, energy and technology, was not made available for an interview before publication, but in 2020, he said the plan to boost production was supported by the fact the offshore is rich with oil reserves. Existing oilfields have about two billion barrels of oil left, but it’s estimated billions more exist.

The first step for Newfoundland and Labrador is to increase exploration because without more sites to drill, more oil can’t be extracted. “Exploration drilling is of highest importance to unlocking hydrocarbon potential,” according to the province.

To do that, Newfoundland and Labrador launched its Offshore Exploration Initiative in 2020, a reimbursement program aimed at increasing the number of exploration wells drilled off the coast between 2021 and 2024. At the time, Parsons said it was important to “incentivize near-term drilling” or else the province’s competitiveness in the global market would be hit.

If Newfoundland and Labrador continues to develop its offshore oil industry, it will be significantly more challenging for Canada to reach its emission reduction targets, and further development will impose devastating consequences for marine ecosystems.

Newfoundland and Labrador has three organizations working to attract investment in its oil industry. They are the province’s Department of Industry, Energy and Technology, a Crown corporation called the Oil and Gas Corporation of Newfoundland and Labrador and the provincial-federal regulator, the CNLOPB.

Together, these organizations study the offshore to find oil deposits and provide data to fossil fuel companies to attract exploration investment. Each year, the regulator opens up an area for investment and invites companies to bid on parcels ripe for exploration. It announced in May that 28 parcels spanning more than seven million hectares are up for grabs in the eastern region of Newfoundland, while 10 parcels covering 2.6 million hectares are available in the southeast area off the province’s coast. Together, that’s an area nearly the size of New Brunswick. Bids are open until November and will be granted in early 2023, according to a press release from the board.

When the pandemic hit, major investments in offshore oil development were put on the backburner. Data shows that in 2019, three exploration licences were issued, compared to only one in 2020 and zero in 2021.

[Top: Illustration by Ata Ojani]