Articles Menu

Mar. 11, 2025

Just hours after U.S. President Donald Trump imposed short-lived but sweeping tariffs across the country last Tuesday, B.C. Premier David Eby took the stage to announce a budget intended to weather incoming economic storms, including ramping up resource development like mining and gas extraction.

“The best way to respond to the tariffs that are being imposed on us by the president is to grow our economy,” he said. “That’s why we’re accelerating major projects across the province.”

But with almost no new spending on environmental or climate programs, critics worry the growth may come at the expense of B.C.’s ecosystems.

“It’s not a happy budget in terms of climate and energy,” said Marc Lee, a senior economist with the Canadian Centre for Policy Alternatives.

Last month, Eby announced his plans to expedite 19 resource development projects across the province to buffer against the shock of the new trade war.

“We know that we have what the world needs, and we’re going to use that to our advantage,” he said during the announcement.

While details on that fast-tracking process remain hazy, Eby has said fast-tracking won’t come at the expense of oversight.

“We’re going to do it consistent with our environmental commitments, but we’re going to do it a heck of a lot faster,” he said.

“I just don’t buy that,” said Torrance Coste, associate director of the Wilderness Committee.

Coste said his skepticism is supported by what appears in the budget. B.C. isn’t adding substantial new investment to areas like environmental assessment and ecosystem protection, Coste said, which he’d expect to see if, for example, environmental assessments needed to happen both more quickly and as thoroughly as necessary.

The budget, which projects a $10.9-billion deficit, devotes the biggest expenditures to new social services, health care and education.

Union of BC Indian Chiefs Grand Chief Stewart Phillip wasn’t surprised that the budget took a modest approach to environmental safeguards.

“We’re in survival mode,” he said. “I don’t think there was an expectation for a lot of sizzle in this budget.”

“But the people that have committed their lives to protect the land and the water will continue to do so,” Phillip added.

Forecasted resource extraction in BC

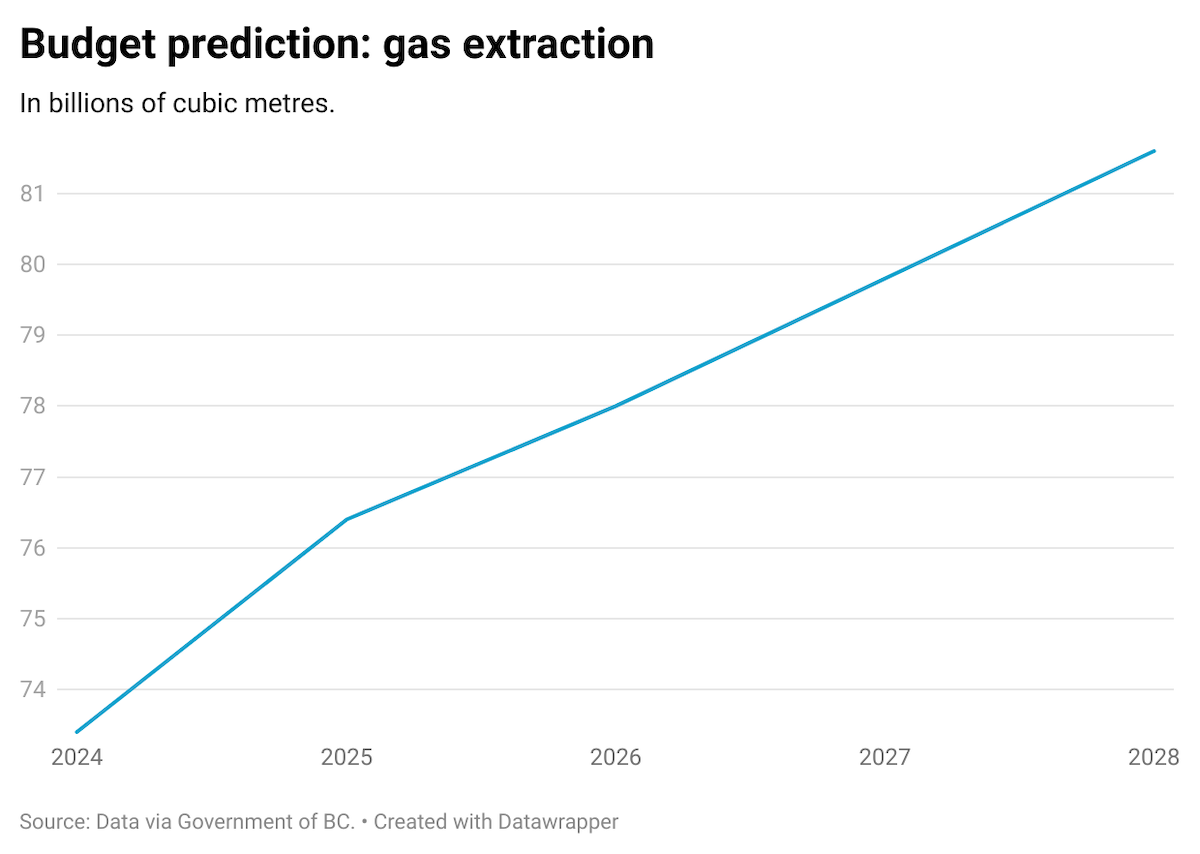

The fine print in B.C.’s budget documents shows the province’s best guess on how much resource extraction is ahead. Across sectors, it anticipates more revenue in the coming years thanks to higher production levels and commodity prices.

That includes a 60 per cent revenue jump from gas, thanks to rising prices and an 11 per cent increase in fracking due to demand from LNG Canada’s anticipated start this year.

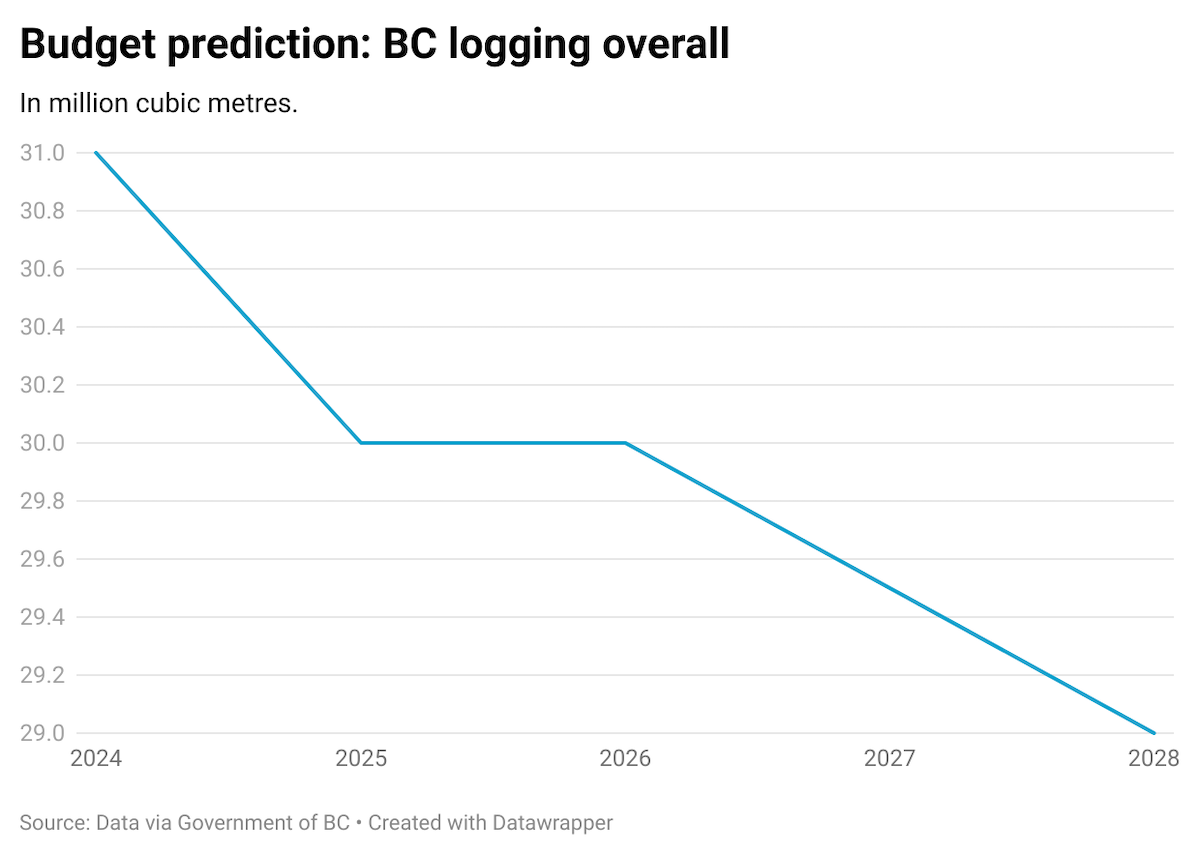

In forestry, B.C. is banking logging totals of around 30 million cubic metres for the next three years, substantially less than the aspirational target of 45 million cubic metres cited in Forests Minister Ravi Parmar’s recent mandate letter. The budget projects that the province will log slightly less each year between 2024 and 2028.

But the province expects a revenue boost, thanks to its predictions of higher lumber prices.

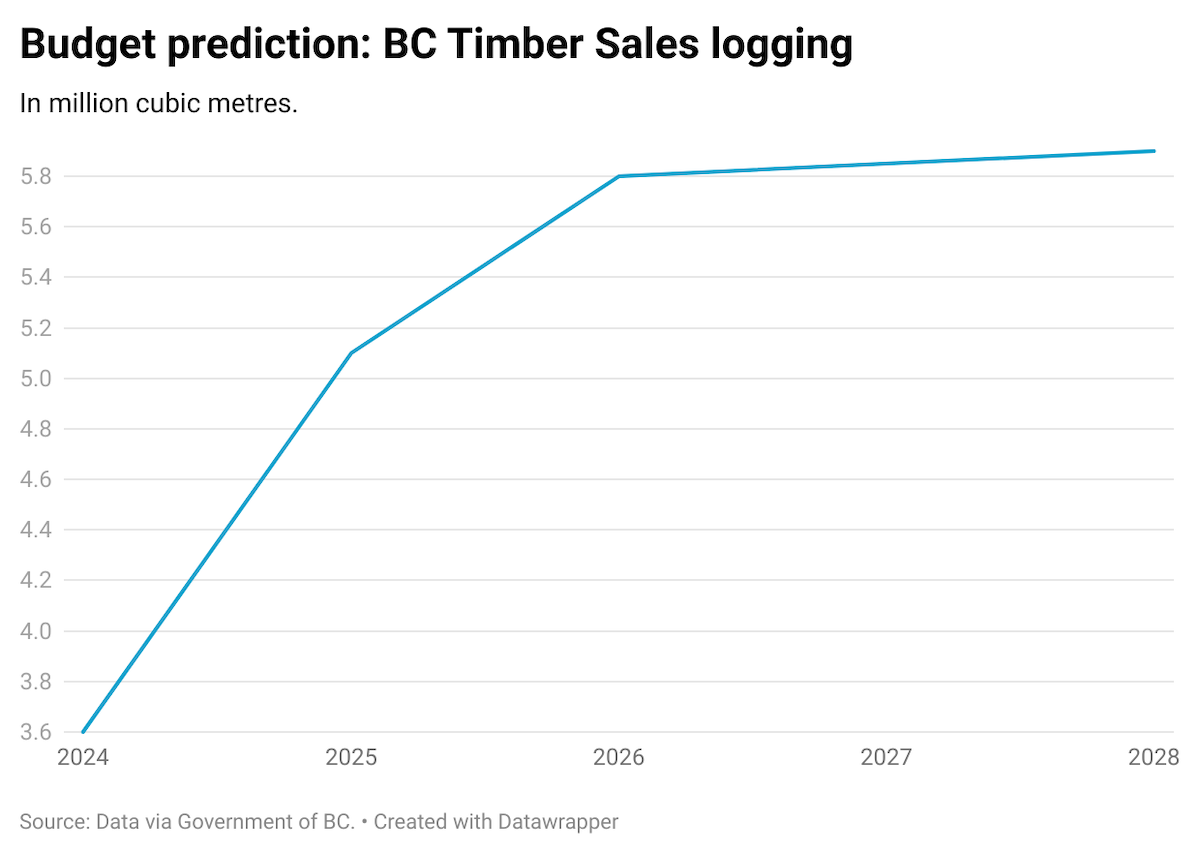

B.C. also indicated that it expects BC Timber Sales, its logging arm, to roughly double its current harvest. This year, the province launched a review of BC Timber Sales to recommend ways it can “create forestry-sector growth,” according to a press release. The review also set a new target to double the BC Timber Sales wood dedicated to value-added manufacturing to 20 per cent from 10 per cent.

Mining revenue is also expected to rise by around 35 per cent. In an email to The Tyee, B.C.’s Ministry of Finance declined to say how much more mining that would require “due to privacy concerns” but added that expected production will come from existing mines and that revenue from the province’s fast-tracked projects would be added in “future updates.”

All told, Budget 2025 makes it clear more resource development is on the way.

Of the 19 projects on the province’s fast-track list, four are new mines or mine expansions. The list also includes an amendment to the Cedar LNG facility, new gas pipelines in northeastern B.C. and to Alberta, a power transmission line to LNG Canada, and several wind projects. The province has said additional fast-tracked projects are on the way.

While this year’s budget adds an extra $270,000 for environmental assessments, given B.C.’s development plans, Coste said that falls short.

“That’s a cut,” he said. “They’re talking about many more project reviews.”

Ecosystem protection falls by the wayside

Besides project-level assessments, the budget provided no new funding to its previous initiatives to take stock of its ecosystems and allocate resource extraction accordingly.

Two years ago, B.C. announced plans to transform its resource management system from one focused on production to one that prioritizes ecosystems. The Biodiversity and Ecosystem Health Framework included a commitment to launch an office in the public service to steer the changes and develop legislation to codify the new approach into law.

“That law is absolutely necessary,” said Sarah Korpan, legislative affairs specialist with Ecojustice, who said current laws “prioritize natural resource extraction with very few checks and balances in place.”

This year’s service plan made no mention of the framework, and the budget cut funding pools within the Ministry of Water, Land and Resource Stewardship that might have achieved it.

While the budget increased investments in the ministry’s permitting for resource development projects, it cut $18.5 million from the ministry’s budget for land-use planning and programs that identify and address the cumulative effects of development.

Korpan worries that fast-tracking resource development without establishing those guardrails could spell trouble.

“It’s really setting us up for a lot of problems that we will be forced to address in the future,” she said.

Climate spending flatlined

B.C.’s budget held its climate-related programs steady, with the exception of a new $100-million investment in heat pumps — a product of its agreement with the BC Green Party.

That’s not enough to counterbalance B.C.’s actions in the other direction, said Lee.

This year LNG Canada is slated to begin operations, liquefying gas from growing fracking operations in the province’s northeast and becoming the province’s single largest source of emissions.

Lee said that impact, combined with B.C.’s current slate of climate policies and investments, makes the province’s 2030 climate target unattainable.

“There’s no way in hell B.C. is going to meet its targets,” he said. “It’s pure vapour to imagine that B.C. is anywhere close.”

When asked by The Tyee whether the province intended to meet its climate targets, Finance Minister Brenda Bailey referred the question to the ministry’s technical teams, who said B.C.’s targets would be under review in a forthcoming assessment of the province’s climate plan, CleanBC, soon to be launched as part of its agreement with the Greens.

Deeper cuts to B.C.’s climate plan may be coming soon.

The province has promised to scrap its consumer-facing carbon tax if the federal government does the same. That cut would result in a $1.65-billion annual drop in provincial revenue — a cost that wasn’t factored into the province’s budget. Currently, part of this revenue helps fund CleanBC.

B.C.’s carbon tax system for oil and gas companies remains, but it includes lots of free passes: about two-thirds of company emissions are exempted from the tax, and even then, they can replace tax payments with offsets and investments to green their operations.

As B.C. stares down a future rife with economic upheaval, Jessica McIlroy, manager of the Pembina Institute’s buildings program, is sympathetic to the rock and the hard place the province finds itself between. Economic priorities “are immediate priorities we have to react to,” she said.

But McIlroy sees the budget as a missed opportunity to invest in projects with a through line to a clean economy, such as new electricity transmission infrastructure to Alberta that could help both provinces use electricity more efficiently and get off fossil fuels.

“It’s not easy, but if we take the right steps and do that slow build to a new economy, it will have the long-term gains we’re looking for.”

[Top photo: BC’s budget documents show the province anticipates a 60 per cent revenue jump from gas, thanks to rising prices and an 11 per cent increase in fracking due to demand from LNG Canada’s anticipated start this year. Photo via LNG Canada.]