Articles Menu

Nov. 30, 2024

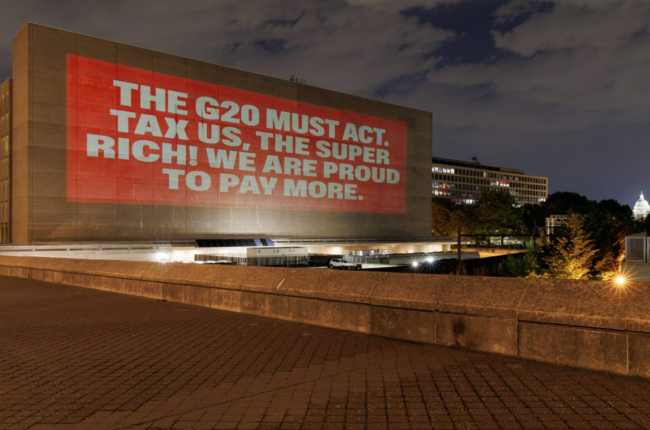

Ahead of next year’s federal election, there’s still time for Canadians to avoid the trajectory of our southern neighbour. We can cast a vote to tax the rich instead.

Taxing the rich is more than a catchy slogan — it’s a crucial component of progressive economic policy. While the most commonly known methods of taxing wealth include an inheritance tax, annual wealth tax, and luxury tax, there are many more ways to tax the rich, some of which could substantially impact housing affordability in Canada.

Conservative lobbyists have long pushed the false narrative that corporate wealth signifies a booming economy and prosperity for all. But when you look at corporate profits in Canada, it’s clear that that wealth isn’t benefiting everyday people; instead, it’s doing little more than making the rich richer. Between soaring profits and the deepening affordability crisis, it’s urgent that more of this surplus go into our shared resources.

Hundreds of thousands of Canadian renters are funding wealthy folks’ investment opportunities — many using food banks and working multiple jobs just to keep up with the rapidly increasing rents.

We could be generating billions in new revenue to build affordable housing for Canadians. Instead, Canada’s largest corporations are underpaying workers and forcing them to live paycheck to paycheck, many just one renoviction away from homelessness.

According to a recent report by Canadians for Tax Fairness, corporate tax breaks are fanning the flames of Canada’s housing affordability crisis. The financialization of housing is spreading across Canada as the real estate industry is increasingly profiting from the sale of housing that everyday Canadians desperately need.

In 2023, rents increased by eight per cent while wages grew by only five per cent. At the same time, the real estate sector collected $50.4 billion in profits in 2023 — a staggering 40 per cent higher than its pre-pandemic record.

Much of these wildly outsized real estate profits are being generated through corporations and financial firms. These firms own 20 to 30 per cent of purpose-built rental housing and are the majority purchasers of multi-family dwellings in Canada. In particular, real estate investment trusts (REITs) have grown to two-thirds of all real estate assets traded on the TSX.

These extreme tax breaks have encouraged investors to treat housing as a commodity, with no incentives to preserve affordability for the one-third of Canadians who rent their homes.

Similar to hedge funds, REITs are trusts that must hold the majority of their assets in real estate and distribute most of their profits to investors each year. Over the past few decades, REITs have become a significant presence in the rental market. They’ve gone from owning zero rentals in Canada in 1996 to nearly 200,000 units today.

One key reason that REITs are so popular: their income is distributed to investors tax-free. In 2022, $100 million collected by the largest seven residential REITs was distributed to investors, exempt from taxation through the partial inclusion of capital gains. While the capital gains loophole was lowered in 2024, it still results in a sizeable tax break.

Investors in REITs pay exceptionally low taxes on their income, the vast majority of which comes from renters. These extreme tax breaks have encouraged investors to treat housing as a commodity, with no incentives to preserve affordability for the one-third of Canadians who rent their homes.

REITs continue to eat up our affordable housing stock while cranking up rents to obscene heights. Hundreds of thousands of Canadian renters are funding wealthy folks’ investment opportunities — many using food banks and working multiple jobs just to keep up with the rapidly increasing rents that financialized landlords invariably demand.

We could be generating billions in new revenue to build affordable housing for Canadians. Instead, Canada’s largest corporations are underpaying workers and forcing them to live paycheck to paycheck.

The crisis is exacerbated by the fact that the value of a REIT is a direct function of a property’s rental income. By increasing rents, financial firms increase both their flow of rental income and the value of their investment properties, producing a much larger capital gain when sold. Both the capital gains loophole and tax breaks for REITs incentivize increasing rents for Canadians.

Existing rent control laws in many provinces cap rent increases only on occupied apartments, increasing the incentive for firms to evict tenants and raise rents without restriction. If these tax exemptions didn’t exist, it would substantially temper evictions and stop driving up rents.

For years, housing advocates have been sounding the alarm about REITs and their undeniably destructive impact on affordable housing in Canada. Their message is clear: as long as we encourage using housing as an investment opportunity, rents will continue to climb. Despite experts pushing relentlessly for the federal government to take action, the finance department quietly posted that “no changes to the tax treatment of REITs are being considered at this time” on their website in May 2024, leaving renters at the mercy of financial firms.

When investors take control of housing stock, the pressure to generate profit rapidly increases. Financialized landlords are incentivized to push people out so that they can charge new tenants significantly higher rents or use the unit to make even more profit off short-term rentals. This displacement of renters has eliminated the affordable housing stock and caused rents to skyrocket for everyone.

Renters continue to face the threat of bad faith evictions, renovictions, and painfully unaffordable rent increases; renting is inherently precarious, as the 33 per cent of our population who rent well know. Meanwhile, REITs are pushing people onto the street to pursue their sole mandate: increasing profits for their investors.

If our government leaders really want fairness for every generation, they need to implement the progressive tax policies that will create it: end tax breaks for REITs, fully close the capital gains loophole, and use that money to build stable, affordable housing for all.

Erica Shiner is the communications coordinator with Canadians for Tax Fairness