Articles Menu

Nov. 4, 2025

Prime Minister Mark Carney’s first budget did not deliver new investments on climate or clean tech. In fact, some experts say it takes a step backwards.

The “climate competitiveness strategy” Carney has been teasing spanned 10 pages out of the 406-page document. It committed to improve the federal government’s emissions reduction workhorse — the industrial carbon pricing system — but provided precious few details on how it would do so, while leaving the door wide open to ditching the proposed cap on oil and gas sector emissions and weakening greenwashing rules.

There’s almost no new climate spending and more cuts to climate-related programs than have been seen in a decade, he said.

The government claimed “smart, strategic investments” of a total of over $140 billion in new money would spur $1 trillion in investments over the next five years.

Keith Brooks, programs director at Environmental Defence, an NGO, said the budget and the Climate Competitiveness Strategy had been an "opportunity for Canada to supercharge the energy transition needed for a strong, future-focused economy," but had turned out to offer "little substance and no new measures."

Instead the new budget extended fossil fuel subsidies, watered down anti-greenwashing rules, and "created a path to axe" the planned oil and gas emissions cap, he said.

One of the only bright spots on the climate front is a $40 million commitment for a youth climate corps, something environmental groups have been calling for for a long time, although “it's really a pittance in the context of the budget,” Mertins-Kirkwood said.

Along with cuts to climate action cuts and vague regulatory commitments, the government is extending renewed support for liquefied natural gas (LNG) projects and carbon capture and storage (CCS).

“[The budget is] a net negative on the actual fiscal front but also on the regulatory front,” Mertins-Kirkwood said. Although there are some positive developments, there is also “a real commitment to weaken things,” including cuts of “at least $3 billion in climate programs”, while the government still found more than $300 million for new fossil fuel subsidies.

“At a moment when we should be moving away from the US-dominated fossil fuel trade and aligning ourselves with global momentum toward a cleaner economy, the federal government is doubling down on oil and gas,” he said.

A special emphasis was placed in the budget on critical minerals and rare earth elements, a group of metals and minerals central to energy transition and defence technologies that are classed as an “important part” of Canada’s Climate Competitiveness Strategy.

The budget earmarks $2 billion over five years to Natural Resources Canada to create a Critical Minerals Sovereign Fund that will make strategic investments in sector projects and companies, including equity investments, loan guarantees, and offtake agreements — through which the government would purchase critical minerals to send a “market-supporting signal.”

There is a further $370 million over four years, starting in 2026-27, to create what the government has dubbed the First and Last Mile Fund, which would support development of key sectoral infrastructure and supply chains with a focus on “getting near-term projects into production.”

The budget also expands eligibility for the critical mineral exploration tax credit to include another 12 critical minerals necessary for defence, semiconductors and clean energy technologies.

The $2 billion sovereign fund has promise because it could potentially include public equity stakes in critical mineral projects, Mertins-Kirkwood noted. However, framing this as climate or clean tech spending is “erroneous.” In fact, the budget does not frame any of its measures around actual emissions reductions, which is the only metric that matters in terms of fighting climate change, Merton-Kirkwood said.

“The broader point here is that this budget does not in any way imply that we are going to be reducing or moving away from fossil fuel production. It's very clear that oil and gas competitiveness is a central part of the economic plan moving forward,” he said.

Mertins-Kirkwood calculated a new subsidy for LNG to the tune of $300 million.

“Three hundred million dollars is not huge in the context of subsidies, but in the same budget where we have no new money for climate, they still found money for a new fossil fuel subsidy,” Mertins-Kirkwood said.

Canada's greenhouse emissions — at the heart of the growing frequency of extreme weather events, wildfires and rising sea levels — rose last year after decreasing by 8.5 per cent between 2005 and 2023.

The government, referencing figures that excluded 2024 data that revealed emissions were increasing, said it was “committed to reducing” GHG emissions. But in the budget’s five-point plan, there were no concrete measures to do so.

The budget committed to "improve the effectiveness” of industrial carbon pricing with no specifics on how exactly it would do so beyond working with provinces and territories to set a “multi-decade industrial carbon price trajectory that targets net-zero by 2050.” All of this is to be determined pending engagement with the provinces, some of which — including Saskatchewan — want to do away with the industrial carbon pricing system altogether.

Industrial pricing does the heavy lifting

The federal industrial carbon pricing system and backstop is Canada’s heaviest hitting emissions reduction policy. According to the Canadian Climate Institute’s 2024 estimates, pricing policies applied to big industrial emitters will be responsible for between 20 and 48 per cent of emissions reductions expected from Canada’s Emissions Reductions Plan. Since then, however, Alberta has frozen its industrial price and Saskatchewan reduced it to zero, and the CCI predicts Canada will miss its climate targets due to increasing oil and gas sector emissions.

The federal government will “promptly and transparently” apply the federal backstop whenever a provincial or territorial system falls below the benchmark, according to the nearly 500-page budget document. This would have implications for Saskatchewan, which reduced its industrial price to zero on April 1.

The government did not outright say it would scrap the emissions cap, but the proposed regulations to cap oil and gas sector emissions “would no longer be required” if the industrial pricing regime and methane regulations are strengthened and carbon capture and storage technology is deployed, according to the budget.

Currently, Canada’s large emitter pricing system is “very weak” and could be strengthened by increasing the price, but that's not what the budget commits to do, Mertins-Kirkwood said.

On methane — a GHG far more potent than CO2 in global heating and one “not effectively covered by carbon pricing” in Canada — the government promised to “finalise enhanced regulations for the oil and gas sector and landfills.”

The government said its review of the electric vehicles mandate, undertaken recently in response to sector-destabilizing tariffs imposed by the US, will be concluded in the coming weeks, at which point it will announce its next steps.

While the budget suggests Saskatchewan’s refusal to adhere to the industrial carbon pricing standards will be addressed in due course, the federal government appears to be capitulating to the provinces and industry on some other climate measures.

The budget said recent changes to Canada’s competition laws that crack down on false environmental claims are "creating investment uncertainty and having the opposite of the desired effect with some parties slowing or reversing efforts to protect the environment.”

This is likely a reference to fossil fuel lobby group the Pathways Alliance removing all content related to a net-zero ad campaign on their websites, social media and public communications after the Competition Act’s greenwashing amendments came into effect in early June. Alberta Premier Danielle Smith has also been a vocal opponent of the greenwashing laws.

The government intends to propose more amendments to remove “some aspects of these provisions, while maintaining protections against false claims,” according to the budget.

Carney is ending the Trudeau-era program to plant two billion trees by 2030 in order to save approximately $200 million over four years. To date, the program has committed to planting nearly one billion trees and all existing contribution agreements and funding commitments with provinces, territories and organizations will be honoured.

A major component of the 10-page Climate Competitiveness Strategy was made up of previously announced clean economy investment tax credits, introduced during Justin Trudeau’s tenure.

The government stressed in the budget that “a substantial increase in energy supply is required to support the growth of Canada’s population and economy,” including from key power-hungry industries such as oil and gas production, pulp and paper, metal and mineral extraction and steel and aluminum manufacturing, as well as from AI data centres and electric transportation.

“To meet this growing demand for clean energy, Canada will need to modernise its electrical grids. To achieve this, we will attract significant new investments to the sector, enabling infrastructure upgrades, energy storage and new technologies, while also expanding wind and solar investments,” said the government.

“Forecasts indicate that the annual pace of investment needs to nearly triple from current levels to meet anticipated future demand.”

There were no direct investments in Canada’s power grid in the budget, despite this being “an easy slam-dunk” in advancing the country’s energy transition, said Mertins-Kirkwood.

State of Investment Tax Credits:

But though it admitted “the degree of investment needed in that timeframe will be significant,” the ITCs included in the budget remained fixed at 30 per cent for clean energy developments, 37.5 to 60 per cent for carbon capture, utilization, and storage (CCUS) projects, 40 per cent for clean hydrogen systems, and 30 per cent for clean technology manufacturing.

The government said ITC for CCUS is “expected to help reduce greenhouse gas emissions over the 2030 to 2050 timeframe and as such contribute to Canada’s goal of achieving net zero by 2050.”

The budget includes an extension of the full ITC rates for CCUS projects by five years, while also expanding the list of critical minerals eligible for the clean technology manufacturing ITC.

On Friday, Canada announced $6.4 billion for 26 strategic projects under the aegis of the G7 Critical Minerals Production Alliance launched this summer.

The government said it would also explore adding a domestic content requirement under the clean technology and clean electricity ITCs.

Carney’s first budget is consistent with Trudeau’s 2023 budget that handed the reins to corporations with its suite of investment tax credits.

Darius Snieckus and Natasha Bulowski / Local Journalism Initiative / Canada’s National Observer

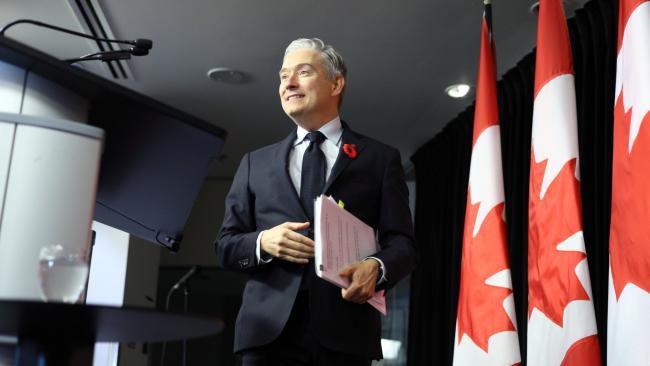

[Top photo: Federal Finance Minister François-Philippe Champagne holds a press conference in Ottawa before tabling the federal budget on Nov. 4. Photo by: Natasha Bulowski / Canada's National Observer]