Articles Menu

Feb. 20, 2020

This was supposed to be the year of LNG for British Columbia, the year that its new export industry started sending billions of dollars in royalties flooding into the province’s coffers, allowing it to pay off its debt and create an energy powerhouse to rival Alberta’s oil sands.

That was the vision that then-premier Christy Clark touted ahead of the 2013 provincial election, in which she talked about the promise of liquefied natural gas exports to Asia and beyond as an economic breakthrough for B.C., with the takeoff point slated for 2020.

But the year of LNG has not arrived – far from it. Instead, there has been close to seven years of increasing struggle by B.C.'s natural gas producers simply to stay afloat. The unforeseen renaissance of U.S. energy production, driven by advances in drilling technology, has sent North American gas prices into the basement, making a global oversupply situation that much worse for Canadian producers.

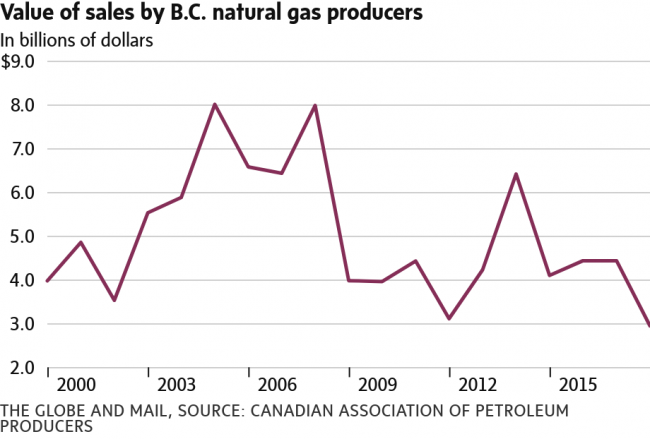

Value of sales by B.C. natural gas producers - In billions of dollars [See chart here.]

After seven years, the promise of LNG exports remains just that. A single project, by LNG Canada, is under construction and slated to begin full operation in 2025, assuming that the Coastal GasLink pipeline is completed and connects the shipping facility to the gas fields of northeastern B.C. (Other projects remain in the planning stage, although some are nearing final investment decisions by their proponents.)

The $6.6-billion Coastal GasLink pipeline is the target of continuing opposition by protesters, including some members of the Wetʼsuwetʼen Nation, backed by most of its hereditary chiefs. But the project, which runs through Wet’suwet’en traditional territories, has garnered support from elected band leaders, as well as other Indigenous band councils along the pipeline route.

The worst may be yet to come, if the industry cannot find an export outlet beyond North America, since the United States – the traditional export market for Canadian natural gas producers – is rapidly moving toward self-sufficiency, says Bryan Cox, president and chief executive officer of the BC LNG Alliance. “The window is now.”

A global LNG outlook from Royal Dutch Shell PLC published Thursday bolsters that view. The energy giant says that global LNG supplies grew significantly in 2019, as companies around the world bet on surging demand, driven in part by moves to replace coal-fired power with natural gas. While prices are currently depressed because of the flood of new LNG supply, Shell is predicting that the imbalance will shrink by the middle part of the decade, with gas prices then rising – right around the time that LNG Canada is slated to begin shipments.

B.C.'s annual revenue from natural gas royalties and Crown drilling rights - In millions of dollars; years refer to end of fiscal period [See chart here. ]

Mr. Cox calls B.C.'s natural gas sector a “foundational industry,” but that foundation is clearly crumbling. The industry’s revenue has fallen by more than half since their 2014 peak, as companies see prices tumble in the U.S. and are unable to access overseas markets. In 2013, the year Ms. Clark campaigned on a future of LNG riches, B.C. producers sold $4.2-billion worth of natural gas. The next year, the boom continued, with $6.4-billion sales. But price declines sent that revenue into sharp decline in the next four years, with just $2.9-billion in revenue last year – a two-decade low.

The government’s royalties have fallen steeply as well. In this week’s budget, the B.C. government forecast an anemic $207-million in natural gas royalties in 2020-21. Even with $168-million from sales of Crown land drilling rights added, the government’s income is woefully short of the $4.3-billion to $8.7-billion that Ms. Clark had confidently predicted that the province would be receiving once the LNG industry was running full throttle. And it is a substantial decline from the peak year of 2008-09, when B.C. took in $1.3-billion in natural gas royalties and $813-million in land rights.

Despite the revenue decline, the volume of natural gas being produced in B.C. has held steady even as commodity prices have plummeted. Employment in the sector has been relatively buoyant as well, even seeing modest growth last year. But that stability would come to a swift and sharp halt without the prospect of LNG terminals that will give the industry access to markets with higher prices and reverse its years-long decline.