Articles Menu

Apr 02, 2021

Last year was $8.2 billion less painful for 77 big fossil fuel companies, thanks to a tax bailout provision in a big pandemic stimulus bill.

The tax-law change did little, however, for nearly 60,000 workers those companies fired, leaving them stretching the $1,200 checks they received under the same law. Individuals were not eligible for the CARES Act loophole, which allows big polluters to reduce past taxes owed based on their recent yearly losses.

As Washington debates ending tax subsidies for fossil fuels, part of President Joe Biden’s $2 trillion infrastructure proposal, fossil fuel companies are quietly reporting their employee headcounts and final tax bills for 2020. The data underscore the hypocrisy of claims that fossil fuels are a necessary engine of employment and succeed on an equal playing field in the free market.

A BailoutWatch analysis of public filings by companies primarily involved in oil, gas, and coal finds:

The bailouts are the tip of a much bigger iceberg: Fossil fuels have long benefited from a trove of tax-code provisions. In the century since they emerged, the coal, oil, and gas industries’ strength has reflected not market efficiencies, as defenders claim, but government largesse that far exceeds what has so far been extended to the clean energy sector. This includes tax deductions for intangible drilling costs and depletion of in-ground fuel reserves, as well as the billions in bailout benefits disbursed under the CARES Act.

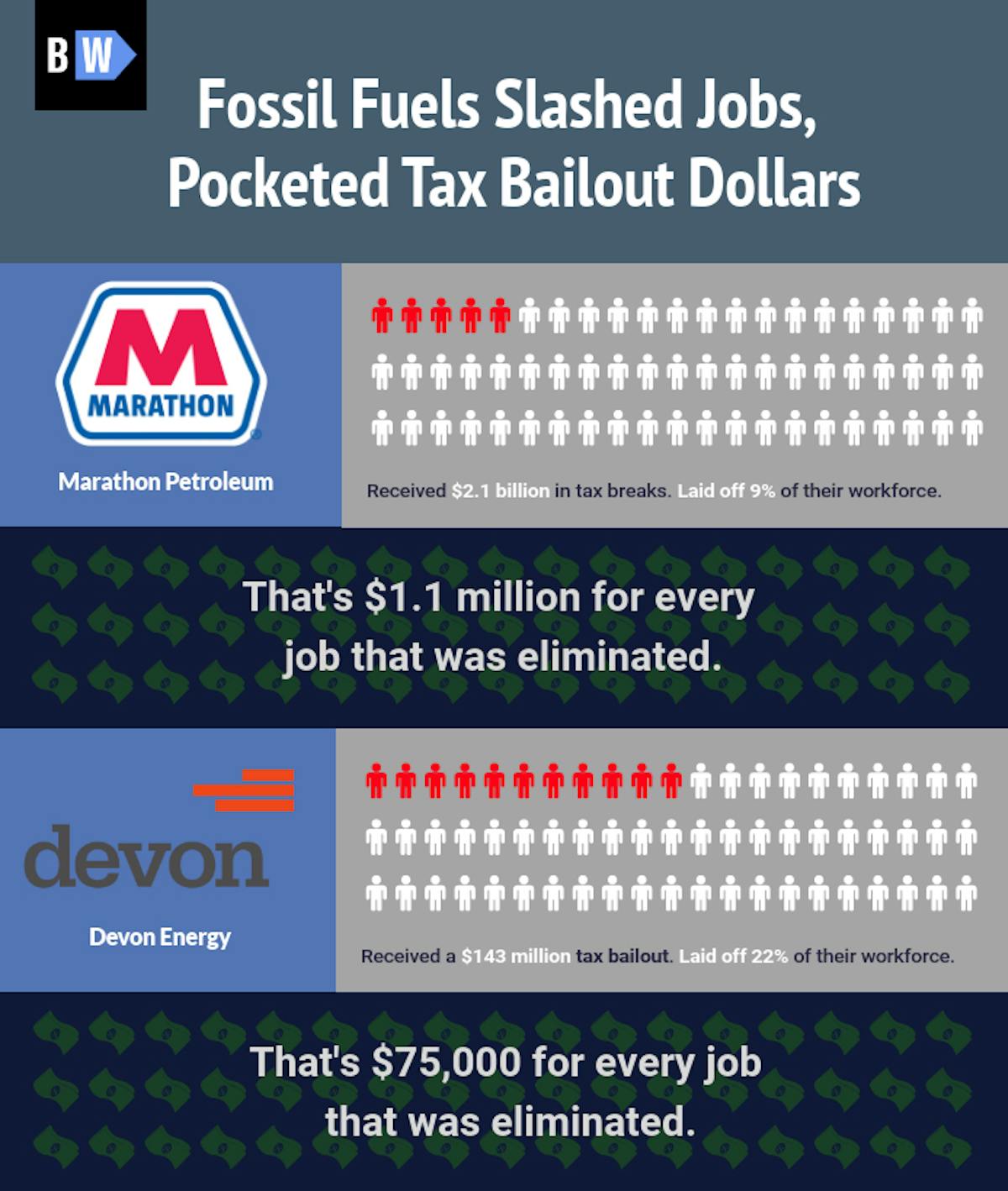

Marathon Petroleum got more than $1 million for every worker it laid off. Others got tens of thousands.

In a $2 trillion infrastructure proposal released by the White House Wednesday, President Biden proposed eliminating tax preferences for fossil fuels and making sure that polluting industries pay to clean up their own messes. It notes that the current tax regime “contains billions in subsidies, loopholes, and special foreign tax credits'' that serve to prop up the fossil fuel industry.

Top oil lobbyist Frank Macchiarola of the American Petroleum Institute responded on Twitter that the proposal would “jeopardize good-paying jobs” and claimed erroneously that “our industry receives no special tax treatment” and supports “a level playing field for all economic sectors.”

Some companies’ coronavirus bailouts were not limited to the tax benefits. At least seven took a collective $37.7 million from the Small Business Administration’s Paycheck Protection Program — money designed to keep people employed. Yet six of them laid off a total of 335 workers, averaging one layoff for every $247,000 they received from the two tax programs.

And seven companies received the implicit endorsement of the Federal Reserve when it included their bonds in its Secondary Market Corporate Credit Facility (SMCCF) portfolio, signaling to investors that it was ready to shore up their bad bets on the companies. Fed support helped oil and gas companies borrow nearly $100 billion from private markets.

The layoff rates among tax-bailout companies are markedly higher than those in the oilpatch overall. In the same period, 4% of oil and gas extraction jobs and 7.5% of coal mining jobs were lost, according to the St. Louis Fed.

That may be a result of the relatively worse financial condition of companies benefiting from the tax changes, which by design only helped those that were unprofitable in 2018, 2019, or 2020. Although the provision did not specifically mention fossil fuels, they were more likely than others to benefit because of the industry’s crumbling finances.

Oil lobbyists like the American Petroleum Institute claim falsely they receive "no special tax treatment."

Companies claimed the $8.2 billion in benefits under two CARES Act provisions that retroactively tweaked steep corporate tax cuts passed in 2017 under former President Donald Trump. One allowed corporations to reduce past tax bills by using losses from more recent years as an offset. Another permitted them to claim certain pending tax credits sooner.

The former reversed one of the few parts of Trump’s tax cuts that fossil fuels objected to. To help pay for broader tax cuts for companies and rich people, the 2017 bill limited companies’ ability to benefit from past losses. The CARES Act restored this industry-friendly deduction, which had long cushioned polluters against the boom and bust cycles endemic to their industry.

The impact of the change was highly concentrated, enabling each of the 77 firms to collect an average of $107 million in benefits. Among the top beneficiaries, the contrast between the millions — even billions — they received and the number of workers they sacked is staggering.

Marathon Petroleum laid off 1,920 workers, about 9% of its workforce, after receiving tax breaks totalling $2.1 billion — about $1.1 million for every job eliminated. Devon Energy laid 22% of its staff, after receiving a $143 million tax windfall — $357,500 for each worker laid off. National Oilwell Varco also slashed payrolls by 22% after receiving a $591 million tax benefit. And Occidental Petroleum eliminated 2,600 jobs, 18% of its 2019 workforce, and collected a $195 million tax bailout — $75,000 in free money per job eliminated.

Nine companies, accounting for $406 million of tax benefits, added a total of 416 jobs — about 3.5% of their 2019 headcounts. Three companies reported no change in employment for 2020. These 12 companies account for $556.6 million of the $8.37 billion in benefits to fossil fuels identified in this analysis.

The full data table can be downloaded here.

[Top photo: Oil workers faced tens of thousands of layoffs in 2020 while their employers raked in billions in pandemic-related tax benefits]