Articles Menu

May 3, 2023

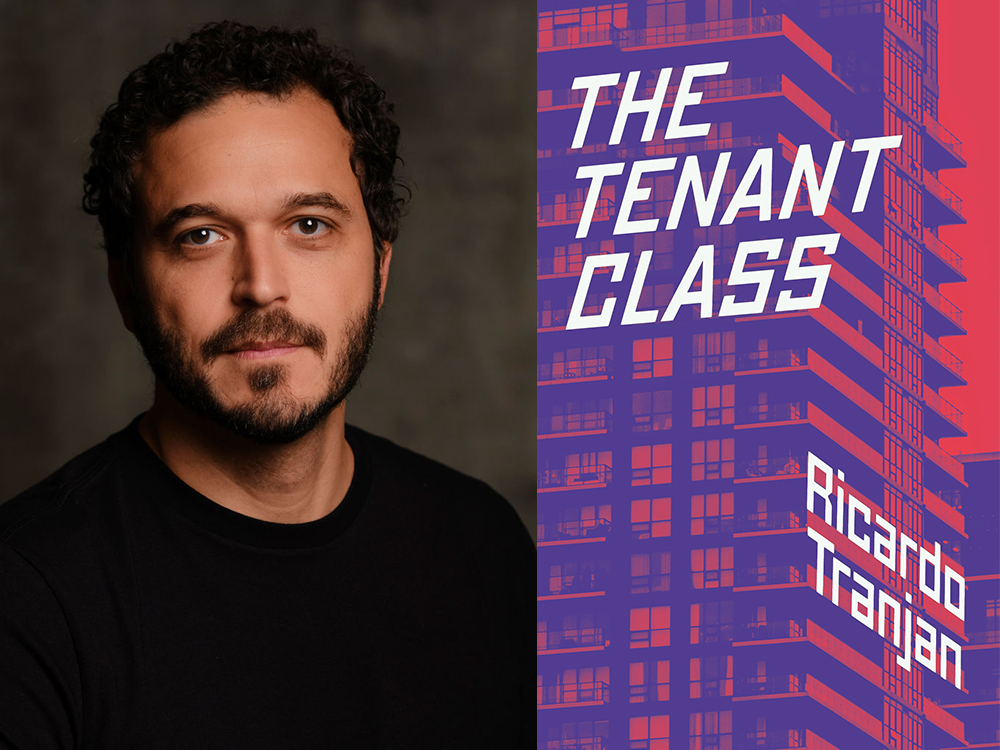

In Ricardo Tranjan’s new book The Tenant Class, he writes that the challenge for the housing “crisis” in Canada is not to find solutions, but rather, to “enact the solutions we know work: move as much provision as possible outside of private markets; tightly regulate the remaining market provision; organize tenants to ensure quality and access.”

Even calling it a housing crisis, Tranjan says, is off-base. It’s rather a situation that benefits some, namely those making good money squeezing tenants for all they’re worth, at the expense of others, namely tenants.

In B.C., this is untenable for many renters. In smaller cities and rural areas, not only is rent too high, but renters are struggling to even find available units. In Vancouver, the vacancy rate is low, too, and rents are sky high, a problem exacerbated by a lack of vacancy controls.

Tranjan, a senior researcher with the Canadian Centre for Policy Alternatives and the former manager of Toronto’s Poverty Reduction Strategy, offers a fresh perspective on the situation. His sharp analysis — alongside stories of tenants organizing and fighting back — provides hope for renters in Canada.

We caught up with him to ask him about pushing back on the common narratives about housing in Canada, non-profit housing, vacancy controls and more.

This interview has been edited for length and clarity.

The Tyee: You write that in Canada, we don’t have a “housing crisis,” but we have a housing system that is based on structural inequality and economic exploitation, benefiting homeowners, landlords, real estate investment firms, banks and developers at the expense of tenants. We’re used to hearing about and writing about the housing “crisis.” Could you expand on your assertion that it’s not a crisis?

Ricardo Tranjan: My main motivation to challenge the notion of a housing crisis is to shift the focus on the types of solutions we’re interested in discussing.

My problem with the housing crisis framing is that it presupposes that everyone is equally motivated in solving the so-called “crisis,” and changing the way things are working.

And then it becomes almost puzzling why we’re not progressing if everyone is so invested in it, right? And then we keep having the same debates and various variations of the same debate.

For me, it was important to challenge and say no, we are not all in the same boat, we’re not all invested in the same way. Actually, some people benefit tremendously from the way things are set up and in some cases they’re acting against any sort of change or solution to this situation.

And I think that provides an alternative starting point for that conversation that I think is more fruitful.

Current public and policy conversations about housing often centre around “affordable” housing. But your book doesn’t — the term only comes up about 30 times. What’s the problem with focusing on “affordable” housing? What should we be focusing on instead?

I bet most of the mentions are in the sections where I’ve criticized the use of the term affordable housing?

Yes, yes. [Both laughing.]

I think the widespread use of “affordable” is yet another way by which we put a veneer of neutrality on the entire housing conversation.

By choosing “affordable” — versus “public,” versus “non-for-profit,” by saying “lack of affordability,” instead of saying “too expensive,” “there’s too much profit in it” — it’s yet another term that helps to disguise the power dynamics behind the so-called crisis.

Some do not have access to housing security, because others are profiting too much from the housing market.

So I not only do not use “affordable,” or use it as little as I can, I harshly criticize the use of the term because I want people to be more explicit about what is their ultimate normative view about housing.

Do they want it to be for profit? Are they okay with so much profit being made off of housing? Or do they think it is not okay, that the profit of some comes at the detriment of housing security for others?

I want those conversations, and I think affordability gets in the way of it.

You make the point that many housing initiatives essentially funnel public money to developers and landlords, both by building housing and by subsidizing rents. What should we be doing instead?

I think we should be focusing on non-profit housing. Governments should be intervening to remove profit from housing, instead of subsidizing private developers in the hopes that they will provide some discounted housing as part of their developments.

This is not specific to housing. It is sort of the ideological consensus in which we live, where governments are so reluctant to act with resolve — to invest, to build, to own, to operate, and instead they have this sort of backseat role, and then provide incentives to the market and hope that they will manage to guide private investment in a sort of desired direction. And it is simply not working.

It is not working when it comes to addressing the climate crisis. It is not working when it comes to making public transit more accessible. It is not working when it comes to housing.

You write that the country used to build a fairly significant amount of non-market rental housing in the 1960s and 1970s, but no longer does. Why don’t we?

In Canada, historically, we have delegated rental housing to the private sector. For quite some time, the approach has been to focus quite a lot on home ownership as the ultimate in desirable outcomes for families, and then to expect and incentivize the private sector to provide rental housing, and in some cases, provide a small percentage of non-market rental housing and some sort of public housing to very low-income families. That has been the recipe traditionally.

There was an exception period, where in the 1960s and 1970s (starting in the 1950s), there was more deliberate funding and creation of non-market housing, both rental housing in general, but also with a larger share of the rental market.

Come the 1980s, neoliberalism starts to kick in, and government starts stepping back and dropping files.

Housing in Canada provides almost a classic example of the government abdicating responsibility: the federal government dumps it on the provincial government, the provincial governments, they’re like, yeah, we don’t want to do that either. A lot of them dump housing on municipalities, and the municipalities are poorer, and they’re like, how are we going to pay for this?

For decades, we sort of just managed what we had, and didn’t invest any more in it. And then in 2015, we have a new party in power at the federal level. And that party promises that we’re going to get back into the housing game, we’re going to have a national housing strategy. And for a while, that had us all a little bit excited.

And then the National Housing Strategy turned out to be predominantly a mechanism to provide more incentives to the private sector, and then some piecemeal funding for non-profit providers, and some direct support to tenants. So it fell short. We’re not back in the game yet.

What do you think about vacancy controls as a potential part of the solution?

Vacancy controls are absolutely part of the solution. There cannot be an incentive for landlords to evict tenants and the absence of vacancy controls is exactly that.

In our context, pushing the tenant out, or not making any effort to keep that tenant, means landlords can increase rent by 10 per cent, 15 per cent, 20 per cent, 30 per cent, whatever the market will bear.

[Editor’s Note: According to the CMHC’s January 2023 rental market report, Vancouver reported an average of 3.9 per cent rent increases for non-turnover units vs. 23.9 per cent for turnover units. In Toronto it was even starker: 29.1 per cent rent growth for turnover units vs. 2.3 per cent for non-turnover units.]

How large of a role do REITs play in unaffordable rents — and what’s the solution to the role they play in the housing market today?

REITs have a bad reputation because of two reasons. First, they’re more aggressive in the repositioning of units, which is what we were just talking about. Their business model, in essence, counts on high turnover rates in order to provide the high rates of return that investors are expecting. They also get a bad reputation because there’s more transparency around those practices, and there’s more documents available.

So you will get to see more clearly what they’re doing, as opposed to all the other large corporate landlords that are not publicly traded.

REITs provide a stark illustrative example of what the industry is, and what landlords can get away with. But I think it’s more of an illustration than a practice that is particular to them and them only.

I believe in regulation. With REITs, part of what we could be doing, and it’s in discussion right now, is to remove the tax exemption that REITs have, which would sort of essentially turn them into corporate landlords.

And then they’d still be these very large firms with a lot of economic and political resources, and we’d still need to curb those practices through regulation, through tight rent controls, through vacancy controls — through all the mechanisms that essentially limit the amount of profiteering in the housing sector.

About a third of people in Canada are renters. And it seems like many people living in cities expect to be lifelong renters. Does this signal a shift in Canadian society? What are the benefits to conceiving of renters as a distinct social class?

It is not new — the share of households renting has been fairly stable for a number of decades. What perhaps is changing, but it’s really hard to know for sure, is the attitude towards renting.

Traditionally, renting was seen as either a transitory place or a failure. So those who did not manage to transition from renting to homeownership and rented for life didn’t achieve the great milestone of the Canadian middle class, which is homeownership, and perhaps that is changing.

What I think is then important is to shift the debate and the political energy from the recurring political promises to access to homeownership, and to start demanding more political action on making renting a more viable alternative.

You quote Dene Indigenous Studies scholar Glen Coulthard early on in the book, making the case that progressive political projects that advocate for communal ownership but ignore the injustice of colonial dispossession risk becoming complicit with colonial dispossession. When we’re talking about something like the need for more social housing to be built, what does a responsible, non-complicit project or program look like?

Well, we’re talking about housing, which is essentially land. At the same time, we’re dealing with the ongoing legacy of colonialism. So how do we bring those two things together? And a reminder that when we say “let’s build more,” ultimately you are asking “where,” and “on whose terms,” and I think it’s important that we continue to ask these things, and pause and take stock.

At the genesis of the so-called housing crisis, we have a moment of a brutal and violent disappropriation, which was the precondition for the setting up of private property, and then of property owners and renters. And that dynamic is then established. And then when we talk about undoing that dynamic, we can’t simply stop at the private property stage. We have to take a step farther down and see what would it mean to undo, or to start over, the entire practice.

I’m afraid I don’t have a satisfactory answer. But in my research, and in my talking to tenant organizers, who inspired and greatly aided in this project, I see that tension and that attempt to also come to terms and find an alternative that is more wholesome.

One point you make in the book is that even if folks have high mortgage rates, they see long-term growth in their personal wealth. The counterpoint I often see made to this assertion is that any moves we could take to deflate unearned equity or decelerate the growth we’ve seen could put a regular middle-class family underwater, or cause them to lose their house, or not be able to help put their kids through university, or see what we saw in the U.S. in 2008. How do you respond to that counterpoint?

It is a good one. And especially because the burden of the crisis fell disproportionately on racialized Americans. So whenever we think of any policy direction that could negatively impact a segment of the population, the first thing that comes to mind is that it’s likely to be particular groups within the population that are actually carrying the burden.

But I would insist that it is ultimately in the broader collective interest that houses are not used as financial assets. And we often think of houses as financial assets when we talk about large investors, and REITs, but houses also function as assets for individual middle-class families that are using them now as their main mechanism for retirement savings, their main mechanism for savings in general.

And that is extremely risky. You’re inflating the market and making it less accessible to those who are outside, but you are also putting those families at an enormous risk.

There are better ways of ensuring long-term financial security for working families. And you know, it’s not a radical idea. It’s called a pension plan. You put resources together over time, and then you know, when folks reach a particular age, they have access to it. But pension plans have become less and less available, especially for workers in the private sector.

I would insist that it is in the collective interest to prevent housing from being used as a financial asset, not only by the large players, but by individual families as well, because of the impact that has on the overall cost of housing, and because it puts these families at too much risk.

I think homeowners have long expected to finish paying their mortgage by the time they retire, so that their fixed costs drop at the same time their income drops, so that they can maintain the same standard of living.

That’s one thing, but now to expect that when you retire you cash in big on that asset — put down payments on houses for your kids, buy a second property that will become your income property — become a mini-investor just based on the value acquired on that property on which you don’t pay tax, it just doesn’t work well.

And again, it puts folks at tremendous risk. There are safer alternatives.

andrea bennett is a senior editor at The Tyee and the author of Hearty: Essays on Pleasure and Subsistence, forthcoming with ECW Press.

[Top photo: ‘Governments should be intervening to remove profit from housing, instead of subsidizing private developers in the hopes that they will provide some discounted housing as part of their developments,’ says Ricardo Tranjan. Photos by Jackie Wong.]