Articles Menu

It is a tragic irony that General Motors (GM) chose its hundredth anniversary in Oshawa to announce the December 2019 closure of its Oshawa assembly plant. This means the loss of over 15,000 jobs in Ontario: 2,200 GM assembly jobs, 300 salaried positions, 500 temporary contract positions, 1,000 inside and 1,000 outside supplier jobs, and a related 10,400 multiplier jobs. The closure of Oshawa’s assembly plant is estimated to decrease Ontario’s GDP by $4-billion per year until 2030, also reducing federal and provincial revenues by about $1-billion a year.1

Over the months following the November 26, 2018 plant closure announcement, GM and Unifor (formerly the Canadian Auto Workers’ union) negotiated the Oshawa Transformation Agreement (May 2019)2 that promises:

It has yet to be seen, whether GM will keep its promise. But even if they do, it will still mean losing over 13,000 jobs and a major hit to the economy.

This preliminary feasibility study offers an alternative. The Government of Canada can provide the leadership to acquire the GM Oshawa assembly plant and repurpose the production to building battery electric vehicles (BEVs). There is a strong business case for this alternative, based on a triple bottom line analysis that considers the economic, social and environmental benefits:

The Oshawa assembly plant closure gives the impression that GM may be on the financial ropes again. Ten years ago, GM received a bail out of almost $50-billion (USD) from the United States government and close to $11-billion (CAD) from the Canadian and Ontario governments. About a quarter of this money, $11-billion in the USA and $3-billion in Canada was not paid back.3 But, today, GM is doing well financially. In 2018, it made close to $11-billion (USD) in before-tax profit on global sales of $147-billion, and its enterprise value has almost doubled in four years, from $77-billion to $138-billion (USD).4 While GM was announcing the closure of four US assembly plants and the Oshawa plant – eliminating 14,700 assembly-related jobs in the process – Mary Barra, the GM Chairman and CEO, was about to receive a $29-million (CAD) compensation package for 2018.5

At the height of Ontario’s auto industry in the mid-1980s, 23,000 people worked at GM Oshawa. With successive “free trade” agreements finally eliminating the Auto Pact, GM has been shifting its production to Mexico and China. And, from GM’s point of view, the reason is simple: GM pays $1.30 to $4.00 (CAD) an hour to its Mexican assembly workers, and $6.80 (CAD) an hour in China.6 In comparison, the wage range for assembly workers in GM Oshawa is $14 per hour (Ontario’s current minimum wage) to $35 per hour (with no increase since 2007), which is similar to Ontario’s median full-time employment income of $68,628 ($33 per hour equivalent).7

Beyond the statistics and the lost pay cheques for workers, the emotional toll on laid off workers, their families, and communities is devastating. “It shatters people’s sense of belonging and identity. The human cost of job loss can be enormous, leading to depression, failing marriages or health, and even suicide.”8

This preliminary feasibility study uses a triple-bottom line approach to answer this question: Can the extremely underutilized GM Oshawa facility be converted to economically, socially and environmentally useful production? This is not a traditional feasibility study that only considers the financial return on investment and whether such an operation can match the global market competition from China, Mexico, South Korea or the United States. Rather, it is based on a triple bottom line evaluation, including:

Humanity is at a turning point, and a majority of us realize it, particularly younger people. They are facing a very different world in the coming decades with climate catastrophe, growing wealth inequality, and the erosion of democratic institutions and processes. Climate scientists unanimously agree that human-caused climate change from burning fossil fuels will escalate in the coming years,9 and unless we take decisive action by 2030,10 our children and grandchildren will face a very unstable world.

“Business as usual” is no longer working. Canadians need to find a way to collectively re-build our domestic manufacturing capabilities while moving as quickly as possible towards a zero-carbon economy. A recent poll found that 65 percent of Canadians feel that “Canada is not doing enough to fight climate change, and 20 percent would buy an electric car”11 to help decrease greenhouse gas emissions. This triple bottom line prefeasibility study shows how we can make a difference, starting with the Oshawa assembly plant.

Electric vehicles are seen as the future of transportation. GM and other transnational auto companies had already invested $90-billion in electric vehicle and battery production by early 2018.12 China is the largest market, currently, for electric vehicles (55% global market share of the 2 million EVs sold in 2018)13 and this is where the global auto companies are investing their billions, including GM. GM has no plans to build electric vehicles in Canada, even though the Oshawa assembly plant and work force are an ideal fit.

The estimated value of the GM Oshawa assembly plant, given its soon to be mothballed production and resulting hit to cash flow, is in the range of $1.3 to $1.6-billion. This is about half of the $3-billion that has been left unpaid by GM from the 2009 bailout it received from the governments of Canada and Ontario, and it is one-third of the $4.8-billion purchase price that the government of Canada recently paid for Kinder Morgan’s Trans Mountain pipeline. The investment required to retrofit the plant to assemble battery electric vehicles (BEVs) on three or more assembly lines is estimated at $400 to $600-million. In 2016, close to $1-billion in federal government grants and loans were given to fifty private companies for manufacturing, cleantech, innovation, agriculture, mining and telecom, including Fiat-Chrysler (FCA) that received $86-million.14 In order to repurpose the Oshawa assembly plant to manufacture battery electric vehicles, the Government of Canada will need to provide a lead investor role.

The two financial scenarios developed for this preliminary feasibility study are based on original equipment manufacturing (OEM) financial benchmarks for start-up/small, medium and large auto manufacturers. The financial forecasts are conservative and have a reasonable growth curve in sales revenue based on government procurement of BEV light duty delivery vans, a BEV car and SUV, and other potential vehicles, such as ambulances. The estimated vehicle fleet prices used for these financial forecasts are within the range of current prices for comparable BEVs.

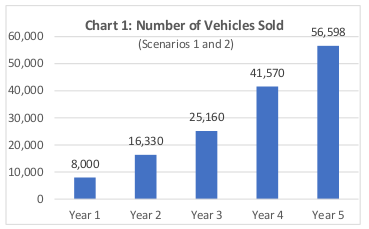

Chart 1 shows the forecasted number of battery electric vehicles that could be manufactured and sold from the repurposed Oshawa assembly plant. Starting in year 1, government procurement (federal, Ontario and the twenty largest municipal/regional governments in Ontario) takes all of the vehicles produced. This helps the new assembly line start up and work out the production kinks. In year two, sales more than double, as sales open up to municipal car-sharing services (as an integrated part of public transit),15 company fleets and private individuals. By year four, with sales exceeding 40,000 BEVs, Scenario 1 reaches its break-even point and Scenario 2 recognizes a small operating profit ($2.4-million). By the end of year 5, the forecasts show that BEVs will represent 30 to 40 percent of these governments’ total fleets, except for Canada Post, which (like the US Postal Service) is expected to replace the majority of their delivery fleet vehicles with BEVs.

Over the first five years of operation, the sales revenue forecasts grow from $340-million to about $2.2-billion. This is a much more conservative growth curve compared to other start-up BEV companies like Tesla (which doubled its global sales in 2018 to $28-billion CAD), and because of the focus on public ownership and procurement, the creation of good jobs, and decreasing climate change gases, the public enterprise will not be solely driven by maximizing profits and shareholders’ wealth.

The gross margin (the difference between sales and the cost of goods manufactured) is conservatively forecasted at 14.3 to 14.5 percent of sales in year 1, growing to 16.3 to 16.5 percent in year 5. The auto industry OEM gross margin benchmarks are in the range of 16 percent (Ford) to 22 percent (Honda), and 2018 operating profits range from -1.8 (Tesla) to 9.8 (Honda) percent (as a percentage of sales revenue). Our financial scenarios show an operating loss each year for the first three years. Scenario 1 has a forecasted break even in year 4, increasing to 0.6% operating income (as a percentage of revenue) in year 5. Scenario 2 – with fewer assembly workers building parts in-house – has a small operating profit of $2.4-million (0.1% of revenue) in year 4, increasing to 0.7% in year 5. These preliminary financial models show that it is financially viable to repurpose the Oshawa assembly plant to build battery electric vehicles.

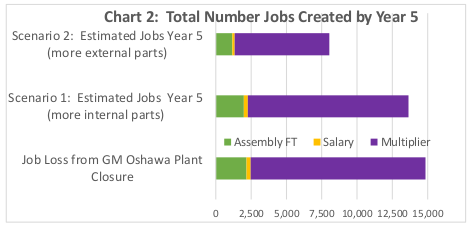

The estimated number of jobs created includes assembly jobs, salaried positions, parts suppliers and other multiplier jobs. Auto manufacturing has an economic/job multiplier in the range of five to nine.16 These forecasts use an economic/job multiplier of five, and use the assembly jobs and salaried positions as the base. Supplier jobs are included in the multiplier.

Chart 2 shows the estimated total number of jobs created as the Oshawa BEV assembly plant scales up by year 5. Starting in year 1 with 325 full-time assembly jobs in Scenario 1 and 200 in Scenario 2, the full-time BEV assembly jobs grow to 1,990 and 1,170 respectively in year 5. Salary positions grow from 50 (Scenario 1) and 30 (Scenario 2) to 290 and 170 respectively, and supplier jobs grow from 100 to 600 in Scenario 1, and 160 to 940 in Scenario 2. The multiplier jobs grow from 1,880 (year 1) to 11,370 (year 5) in Scenario 1, and from 1,140 to 6,700 in Scenario 2. In total, Scenario 1 estimates the creation of 13,600 jobs and Scenario 2 forecasts over 8,000 by year 5. This is in direct contrast to the loss of 5,000 full-time assembly-related jobs (including 2,000 parts supplier jobs) and 12,400 multiplier jobs with GM’s Oshawa plant closure in December 2019.

GM and Unifor have negotiated an agreement to create 300 jobs in the paint and stamping plant in 2020.17 It would be ideal to find a way to maintain these jobs as well, by having GM contract the new publicly owned enterprise, consistent with the GM-Unifor 2016 collective bargaining agreement that promised a “secure future for all locations.”18

These financial scenarios, for repurposing the GM Oshawa plant from internal combustion engine (ICE) vehicles to battery electric vehicles (BEVs), will require the commitment and investment of various governments, with the federal government taking the lead. Public or state-owned enterprises play an important role in most economies. In 2018, they accounted for over 20 percent of the world’s largest enterprises, compared to ten years ago with only one or two public enterprises in the top echelon.19 In Canada, the federal government owns 45 public enterprises (Crown Corporations) with assets of over $1-trillion (which grew by 37 percent since 2013-2014), annual revenue of $92-billion, and annual net income of $56-billion (2017-2018).20 The top two public enterprises are the Canada Pension Plan and Public Sector Pension, with 53 percent of the total assets of all federal Crown Corporations. In addition, provincial and municipal governments own hundreds of enterprises, with total assets exceeding the federal crown corporations.21

For this preliminary feasibility study, we consider democratic, public ownership to include governments, auto workers and community members. The legal structure of the organization can take many forms, including a crown corporation. In any case, the organization will need to use a board matrix to ensure representation from government, auto workers, community members, people with the experience and skills required for the business, and a diverse mix of people (gender and ethnicity).

Scenario 1 estimates an initial public investment of $1.7 to $1.9-billion, and considers the negotiation of a full-scale purchase of the GM Oshawa assembly plant. This preliminary study provides an estimated enterprise value of $1.3-billion for the Oshawa assembly plant, and $400 to $600-million to retool the plant for BEVs. The GM assembly plant includes the land (702 acres or 284 hectares), buildings (about 10 million square feet) and equipment for the auto and truck lines, the body shop, the paint shop, and the auto warehouse and parking lots (for finished vehicle inventory and employee parking). Examples of other large auto assembly plants that have been purchased (or are under negotiation) for electric vehicle production (including some start-up companies):

Scenario 1 estimates an initial public investment of $1.7 to $1.9-billion, and considers the negotiation of a full-scale purchase of the GM Oshawa assembly plant. This preliminary study provides an estimated enterprise value of $1.3-billion for the Oshawa assembly plant, and $400 to $600-million to retool the plant for BEVs. The GM assembly plant includes the land (702 acres or 284 hectares), buildings (about 10 million square feet) and equipment for the auto and truck lines, the body shop, the paint shop, and the auto warehouse and parking lots (for finished vehicle inventory and employee parking). Examples of other large auto assembly plants that have been purchased (or are under negotiation) for electric vehicle production (including some start-up companies):

Scenario 2 is more modest, with an estimated capital cost in the range of $1.2 to $1.4-billion (an estimated enterprise value of $800-million plus the $400 to $600-million required to retool the plant to assemble BEVs). This scenario will require negotiating the purchase of the Oshawa assembly plant (auto and truck lines) and shared use of the body shop, paint shop, and auto warehousing and parking lots.

Neither scenario includes the purchase of GM’s Canadian Technology Centre or test track. Instead, the new publicly owned organization will build a state-of-the-art Transportation-Environment Center that will employ engineers, technicians and skilled trades people who will research future product needs, build and test prototypes, and help re-invigorate Canada’s manufacturing capabilities.

By paying a good wage to auto workers – this study proposes the existing GM Oshawa tier 1 wage of $35 per hour for assembly workers – it will be possible to gain the workers’ commitment by investing in their jobs through shared-ownership of the new organization. The scenarios in this study will require leadership and mobilization of the workers and the broader community to persuade our governments to try a new model of democratic, public ownership. Governments will need to negotiate alongside the workers and community to gain public ownership of the GM Oshawa plant. The financial forecasts include a start-up investment of $10,000 from each of the workers combined with community investment for a total of $37.5-million in Scenario 1, and Scenario 2 estimates $25-million in investment from workers and the community.

Transportation is the second largest source of greenhouse gas (GHG) emissions in Canada, accounting for a quarter of our total emissions, and almost half of these come from cars and light trucks (including SUVs).25 In Canada’s light vehicle market, four pick-up trucks filled four of the top five sales positions in 2018.26 The market share for all light trucks sold in Canada was 70 percent in 2018, up from 68.6 percent in 2017.27 These vehicles have a much higher profit margin for the manufacturers (15 to 20 percent) than cars (3 percent), and are not the types of energy conserving vehicles that need to be produced, given that the average pick-up truck uses 14 litres of fuel per 100 km (17 miles per US gallon),28 and emits more than 4.71 metric tonnes of CO2 per year per vehicle.29 This is the reason that the Government of Canada recently announced targets for sales of zero-emission vehicles: 10 percent of new light-duty vehicle sales to be zero-emission vehicles by 2025, 30 percent by 2030, and 100 percent by 2040. And in May 2019, the new $300-million federal purchase incentive program was opened to encourage more Canadians to buy zero-emission vehicles.

The calculation of greenhouse gas (GHG) emission reductions from moving to BEV from ICE cars and light trucks, depends on the efficiency of the gasoline engine, the weight of the vehicle, the distances travelled, and the source of electricity generation. The US Environmental Protection Agency provides calculators for GHG Emissions, including ICE cars and light trucks.30 Since closing the last coal fired electrical generating station in Ontario in 2014, over 93 percent of Ontario’s electricity generated comes from non-greenhouse gas emitting resources (nuclear, hydro, wind and solar).31 The GHG emission reductions in this study are substantial, growing from a 35,000 metric tonne CO2 reduction in year 2 (the first full year of BEV operation), with compounding growth each year to a total of 400,000 metric tonnes by the end of year 5.

This preliminary feasibility study uses a triple bottom line approach to evaluate whether the GM Oshawa assembly plant could be repurposed to manufacture BEVs and other potential products that will help Canadians meet their needs while also decreasing greenhouse gas emissions.

The study began with a financial analysis of how the Oshawa assembly plant could be used to manufacture BEVs for government procurement to help the federal, provincial and municipal government vehicle fleets meet their climate change commitments. From a financial point of view, using original equipment manufacturing (OEM) benchmarks, the study shows that the new operation could reach a financial break-even by year 4 and make a small profit by year five. This would require an estimated capital investment of $1.2 to $1.9-billion by governments to purchase the Oshawa plant and retool it for BEVs.

From a social point of view, rather than accepting the loss of over 5,000 assembly-related jobs at GM Oshawa, and an additional 10,000 multiplier jobs, this study shows that public investment and procurement can kick-start the new BEV assembly plant to create an estimated 2,300 to 2,900 manufacturing-related jobs and an additional 5,700 to 10,700 multiplier jobs, for a total of eight to thirteen thousand jobs by year 5.

Regarding the environmental impact of the shift to battery electric vehicles from internal combustion engines, greenhouse gas emissions are estimated to decrease in a compounding manner from 35,000 metric tonnes of CO2 after the first year on the road, to an estimated total of 400,000 metric tonnes by the end of year 5.

A number of GM Oshawa workers were interviewed regarding their point of view on repurposing the assembly plant to manufacture battery electric vehicles. They agreed that the plant has the equipment and layout required for assembling BEVs, and in the words of one worker: “There’s no doubt in my mind that we can do this … that in 2019 we can build anything we like if there was the money or will behind it.” And given the climate crisis, another worker commented: “This is a perfect opportunity to say this idle plant can now be used for the new technology, electric vehicles, solar panels, wind turbines, and other products.” •

This preliminary feasibility study of the GM Oshawa facility was conducted by Russ Christianson of Rhythm Communications for Green Jobs Oshawa. Sign their petition “Governments Must Act to Ensure GREEN JOBS for OSHAWA.”

[Top photo: Germany’s Post Office (Deutsche Post) developed and began manufacturing Streetscooter battery electric vans in 2016 to replace its 70,000 vehicle fleet.]