Articles Menu

Aug. 25, 2025

Big banks across the world are substantially increasing their financing of the fossil fuel industry, including for the industry’s expansion during a time of intensifying climate crisis, all while pulling back from previously stated climate commitments.

These are among the key highlights of the most recent Banking on Climate Chaos report, which found that the 65 biggest banks globally committed a whopping $869 billion to companies conducting business in fossil fuels in 2024, representing a huge $162 billion increase from 2023.

“These financial flows reflect the policy retreat of banks abandoning climate goals for short-term profits,” Campaign Director for the Climate and Energy Program at Rainforest Action Network Dianne Enriquez told Truthout.

Banking on Climate Chaos, co-authored by several organizations including Rainforest Action Network, Oil Change International, Indigenous Environmental Network, and Sierra Club, is an authoritative annual study — endorsed by hundreds of organizations across the world — of how banks finance the fossil fuel industry.

The report also shows that U.S. banks like JPMorgan Chase, Bank of America, Citigroup and Wells Fargo dominated the heights of fossil fuel financing. A Truthout analysis reveals that the CEOs of the top six U.S. banks that are financing fossil fuels together made over a half-billion dollars from 2022 to 2024. CEO pay is astronomically larger than the average incomes of communities most impacted by their fossil fuel financing.

“These billion-dollar industries are making money off of our backs while killing us,” Roishetta Ozane, founder of the Vessel Project in Lake Charles, Louisiana, which endorsed the report, told Truthout.

The most notable finding in the new report is that, during 2024, global banks “significantly increased their fossil fuel financing, including ramping up finance for fossil fuel expansion,” with the 65 biggest banks globally committing $429 billion to companies expanding fossil fuel production and infrastructure in 2024.

As the report notes, the “growth in fossil fuel finance is troubling because new fossil fuel infrastructure locks in more decades of fossil fuel dependence.”

“Global banks continue to fuel the climate crisis at an alarming scale,” Jessye Waxman, Sustainable Finance Campaign Advisor for the Sierra Club, told Truthout.

This comes amid intensifying climate chaos and the desperate need to vastly ramp down fossil fuel production, according to the United Nations’ Intergovernmental Panel on Climate Change (IPCC), which has called for “a substantial reduction in fossil fuel use” without delay.

U.S. banks dominated the list of banks increasing their fossil fuel financing, with JPMorgan Chase, Citigroup, Bank of America, Goldman Sachs, Wells Fargo, and Morgan Stanley holding six of the top eight spots. These banks all increased their fossil fuel financing from 2023 to 2024 by a range of 30 percent to 50 percent, amounting to nearly $70 billion more fossil fuel funding between them.

“U.S. banks are leading this surge,” said Waxman, who noted that JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo alone “collectively represent over 21 percent of the total global fossil fuel financing covered in the report.”

The report shows that banks based in the U.S., Canada, Europe, and Japan account for around 83 percent of fossil fuel financing globally, highlighting the massive imbalance of fossil financing profiteering that comes from the Global North while disproportionately impacting the Global South. The report includes case studies on the banking behind contested companies and projects worldwide, such as Mozambique LNG and JSW Steel in India.

“Globally, people are paying dearly,” said RAN’s Enriquez.

All told, the 65 biggest banks in the report have committed a staggering $7.9 trillion in fossil fuel financing since 2016, the year the Paris Agreement, an international treaty to limit global warming to 1.5 degrees Celsius above pre-industrial levels, went into effect, the report notes.

Banking on Climate Chaos also contains findings on howbanks finance fossil fuel corporations — findings that support the claim that banks have been “greenwashing” themselves by giving lip service to climate concerns even as they continue to bankroll climate catastrophe.

Notably, the report found that only 5.3 percent of financing to fossil fuel companies came at the project level, whereas 94.7 percent of it came at the corporate level. This corporate-level financing increased by nearly $117 billion from 2023 to 2024.

In other words, while banks have restricted direct financing of dirty fossil fuel projects that could garner bad publicity, they’ve simultaneously increased direct, unhindered financing to the corporationsdoing business in fossil fuels.

“Banks’ corporate financing loophole is a textbook case of greenwashing,” said Sierra Club’s Waxman, noting that the loophole “gives fossil fuel companies unrestricted capital to pursue harmful expansion.”

“It renders banks’ climate policies toothless by allowing them to maintain the illusion of responsibility, while behind the scenes, they continue to bankroll the fossil fuel industry,” said Waxman.

All this adds weight to accusations of greenwashing: Banks are making face-saving gestures even as they continue to bolster the corporate coffers of the fossil fuel industry.

Meanwhile, the report also highlights many banks’ rapid flight from the net-zero “commitments” that they so adamantly committed themselves to just a few years ago.

The prime evidence of this is the near-total collapse of the Net Zero Banking Alliance (NZBA), a United Nations-supported initiative to align global banks’ lending and underwriting practices with the goal of reaching net-zero carbon emissions by 2050.

Leading fossil fuel financiers like JPMorgan Chase, Bank of America, and Wells Fargo had previously celebrated their self-proclaimed climate concerns by joining the NZBA. But in the face of rising opportunities to capitalize on fossil fuel expansion — from corporate mergers and expanded drilling practices to a new oil-friendly Trump administration — these banks and many more have quit the NZBA entirely. U.S. lawmakers have suggested that banks like JPMorgan Chase have misled the public and investors as it backed away from its purported climate commitments.

All told, the report’s data and analysis support the notion that banks are not passive actors when it comes to the global climate crisis. Rather, banks are active agents maneuvering to keep bankrolling fossil fuels corporations, and they have revealed their climate commitments to be exceedingly thin.

The report starkly illustrates how U.S. banks dominated global fossil fuel financing in 2024, occupying half of the top dozen slots. JPMorgan Chase was the top bank financing fossil fuels ($53.5 billion), with Bank of America second ($46 billion), Citigroup third ($44.7 billion), Wells Fargo fifth ($39.3 billion), Goldman Sachs tenth ($28.5 billion), and Morgan Stanley twelfth ($27 billion).

Top executives at these banks have also personally profited enormously as they’ve overseen an expansion in fossil fuel financing in recent years. A Truthout analysis shows that, according to their banks’ most recent proxy statements, from 2022 and 2024, the CEOs of these banks together raked in well over a half-billion dollars — $543.75 million in total — in their total compensation.

In 2024, these six banks’ CEOs took in a total of $185,350,903 million, or an average of nearly $31 million.

Notably, this CEO compensation is astronomically higher than the per capita incomes of communities most impacted by the fossil fuel projects overseen by companies that their banks are financing.

One of those communities is Lake Charles, Louisiana, which is surrounded by fossil fuel and petrochemical facilities. As Truthout previously reported, local organizers like the Vessel Project’s Ozane are resisting the construction of facilities like Venture Global’s huge new LNG export terminal, Calcasieu Pass 2.

Banking on Climate Chaos notes that Venture Global LNG’s top two bankers in 2024 were Goldman Sachs and JPMorgan Chase.

In 2024, Jamie Dimon, CEO of JPMorgan Chase, was the top earner in 2024 with $39 million. (As of April 2025, Dimon also owned 7,186,564 units of JPMorgan stock, worth today around over $2 billion.) By contrast, the per capita income in Lake Charles, Louisiana, is $35,847. This means Dimon took in 1,087 times the per capita income of a Lake Charles resident last year. Ted Pick, CEO of Morgan Stanley, took in $24,881,032 in 2024, or 694 times the income of an average Lake Charles resident. (It’s worth noting that while Morgan Stanley’s April 2025 proxy statement reported Pick’s 2024 compensation at $24,881,032, an earlier February 2025 filing said his 2024 compensation was set as $34 million, which would be 948 times the income of an average Lake Charles resident).

The injustice of these stark disparities resonates with Ozane, who told Truthout she founded the Vessel Project amid the destruction caused by climate-induced disasters that included Hurricanes Laura and Delta. “I started connecting the dots and really looking at the intersection between these low-income neighborhoods facing these crises versus the polluters who are causing these climate-induced disasters,” Ozane said.

Ozane called Jamie Dimon’s 2024 compensation of $39 million “staggering,” especially given that it was “based off investments in fossil fuel projects that are not only killing the people in my community, but harming this entire world.”

“It highlights the troubling disconnect between the financial elite like Jamie Dimon and everyday people like myself and my community members,” she said. “It’s especially troubling when his bank finances a project like Venture Global, which is the largest polluter when it comes to methane gas, and it’s right there in my community, a community that is struggling.”

Banking on Climate Chaos ends with robust demands aimed at curbing bank financing of fossil fuel expansion, instituting policies to advance the transition from fossil fuels and securing climate, protecting human and Indigenous rights, and securing a just and fair energy transition.

“Ultimately, we’d like for banks to immediately halt financing fossil fuel companies that are doing fossil fuel expansion,” Enriquez said.

Waxman also pointed out the need for regulators to “set strong, binding policies — at all levels from regional to state to national — that incentivize banks to clean up their act or face significant penalties.”

Ozane wants to see financial institutions from Citi and JPMorgan in the U.S. to Mizuho and MUFG in Japan take a more responsible approach to their investments and prioritize funding for renewable energy.

“It’s time for these institutions to align their practices with the urgent need for climate action and the urgent need to put people before profit,” she said.

Derek Seidman is a writer, researcher and historian living in Buffalo, New York. He is a regular contributor for Truthout and a contributing writer for LittleSis.

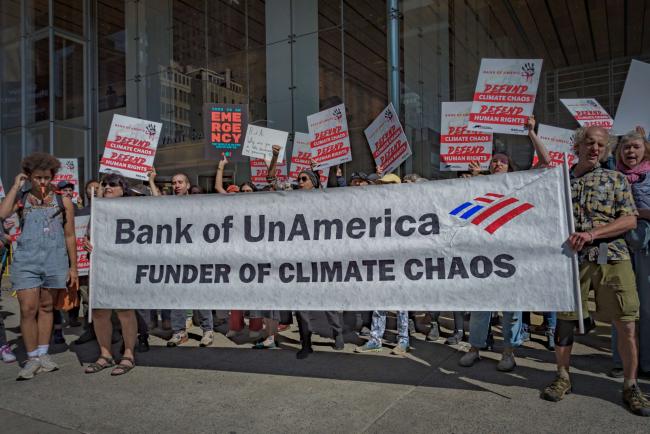

[Top photo: Climate activists rally outside Bank of America Tower in Midtown Manhattan as part of the March to End Fossil Fuels on September 19, 2023. Erik McGregor / LightRocket via Getty Images]