Articles Menu

Oct. 12, 2022

“The operating word is uncertainty.” So observed RBC CEO Dave McKay, effectively speaking for his class about the state of Canadian capitalism. The blithe confidence that the ruling class normally exudes – and did exude until relatively recently – has faded. In the face of economic stagnation, spiralling corporate and household debt, inflation, and an inverted bond yield curve, the ruling class in Canada is now favouring blunt honesty: it doesn’t really know where the economy is headed, just that the storm clouds lurking on the horizon are darkening ominously.

The bourgeois media treat capitalism as a stable social system that’s improving the well-being of everyone. They treat crises like the one we’re facing as exceptional if unfortunate imbalances, whose causes are external to the capitalist system. But reality looks nothing like the imagination of the system’s apologists. Capitalism is a social order that is inherently volatile, violent, crisis-prone, and incapable of meeting the full range of human and ecological needs. Understanding these dynamics and capitalism’s crisis tendencies is vital to grasping why human flourishing and ecological sustainability can never be achieved in such a system.

And the truth is that the contradictions of Canadian capitalism – and thus our need to understand them, and prepare to meet their challenges – have been deepening since well before the pandemic, however sanguine the ruling class may have been about its sure-footed economic and fiscal management.

In 2020, a few weeks before the COVID-19 pandemic shutdowns began, we published an article in Briarpatch Magazine analyzing the dynamics of capitalist accumulation in Canada. Seeking to offer readers a Marxist explanation of capitalism’s “laws of motion,” we argued that Canadian capitalism was facing profound contradictions that were leading it towards a crisis: profitability had been in decline; capital accumulation was faltering; and both corporate and household debt had risen to unsustainable levels. We suggested that in response, Canadian capital and the state were pursuing, on the one hand, an aggressive policy of increased exploitation of workers, and, on the other, a desperate bid to get oil and gas to Asian markets – and reproducing a ruthless settler-colonial logic in the process.

Then the pandemic threw global capitalism into a tailspin. Despite experiencing the biggest decline in GDP since the Great Depression, however, Canadian capitalism was stabilized relatively quickly for a crisis of such magnitude. For example, after turning negative for two months, GDP grew sharply in May and June of 2020, before settling close to its anemic pre-pandemic rates. Unheard of during most periods of such sharp contraction, business insolvencies actually declined in 2020, despite the significant growth of indebtedness in the years before the pandemic. This stability was the result of state policies to keep capitalism from imploding. From spring 2020 to late 2021, the Bank of Canada injected more than CAD $550 billion of liquidity into the financial system, to stave off an economic collapse by keeping interest rates – and thus the cost of borrowing – low, particularly for companies. The federal government in turn spent more than $250 billion on a series of programs to keep businesses afloat and workers connected to the labour market.

But this stability has proven to be fleeting. The state’s extraordinary COVID measures were a temporary salve to shepherd Canadian capitalism through a tumultuous global health crisis. Once the COVID-19 programs ended and public money dried up, it was only a matter of time before the system’s deeper contradictions reappeared, perhaps with even more volatility than before. By the spring of 2022, talk of a recession haunted the pages of the bourgeois media.

Bourgeois media, politicians, and social scientists tend to reduce the root causes of capitalist crises to their immediate precipitating events. In this view, the Great Depression was the result of a stock market crash; the 1970s recession, of an oil price spike, or of “stagflation” caused by workers successfully striking for higher wages; the 2008-09 Great Recession, of a mortgage and derivatives market collapse. Today, most mainstream observers point to escalating inflation as the cause of the coming recession. They suggest we face a “wage-price spiral” that needs to be eradicated before it gets out of control – where workers respond to rising prices by driving up wages, which leads businesses to increase prices still more – despite a dearth of evidence to substantiate the claim.

Inflation is no doubt a problem for both capitalist investors and workers. Rising prices eat away at the profits that capitalists earn on past investments and the real value of workers’ wages. In particular, the massive jump in energy prices resulting from supply chain problems and Russia’s invasion of Ukraine is a serious problem for both capitalists and workers.

But we should not lose sight of the fact that crises are an integral feature of capitalism. Businesses produce commodities for sale on the market with the aim of making profit. Profitability – not human need – drives investment. But over the course of its cycles, capitalism has difficulty maintaining sufficient profitability to warrant investment in new machinery, equipment, and business infrastructure such as buildings and logistics networks. Long periods of relative stability are spurred by a growing rate of profit (the amount of profit obtained relative to the costs of producing commodities) and mass of profit (the total magnitude of profit produced in a given period). But capitalism has difficulty sustaining profitability. The rate of profit falls and eventually the mass of profit stagnates or declines, and a long period of instability follows. During these long periods of instability, the economy becomes more fragile and susceptible to shocks.

Indeed, it’s a testament to the utter irrationality of capitalism that the system requires crisis to address the falling rate of profit. Crisis wipes out the least competitive and productive companies and drives up unemployment, which opens up market share for the businesses that survive and makes workers far more vulnerable to attacks on their wages and working conditions. In short, crisis improves the conditions for profit-making and can help to bring about a new long period of stability. As the Polish Marxist Henryk Grossman observed in 1929, in his powerful analysis of capitalism’s breakdown tendencies published right before the Great Depression hit, “From the standpoint of capital every crisis is a crisis of purification.”

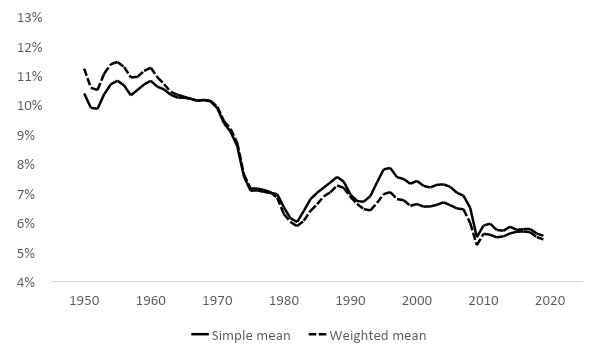

Global capitalism in general, and Canadian capitalism in particular, has been due for a significant crisis, as Marxist observers have been arguing since well before the pandemic hit. Figure 1, below, shows the G7 countries’ average annual rate of profit between 1950 and 2019. As can be seen, the rate of profit (using the weighted mean – weighted according to the size of the country’s capital stock) fell from 11.5% in 1955 to 5.9% in 1982, at which point the capitalist class began to gain ground on the working class as the strike wave of the 1970s was defeated by the state and employers, wage growth was brought under control, and productivity was driven up. The G7 rate of profit started to rise, albeit modestly, until 1996, after which profitability problems began to return. It’s then that the Asian financial crisis occurred, followed by the emergence of the dot-com bubble. The bursting of the latter in 2000, together with a lowering of interest rates to encourage more borrowing by households, precipitated a shift towards speculative investment in real estate – laying the groundwork for the housing bubble that burst several years later and triggered the global financial crisis of 2007.

Figure 1 – Internal rate of return, G7 countries

Source: Penn World Table, version 10.0, authors’ calculations

Capitalist profitability and accumulation failed to recover from the 2008-09 Great Recession. Then, a year before the pandemic hit, warning bells sounded as bond yields inverted, auguring a recession within a year or two. (Under normal conditions, the yield – or return – on short-term debt instruments is lower than the yield on long-term debt instruments. When this situation inverts, meaning investors are seeking a safe haven in long-term bonds, it represents an important signal that something is awry – a signal that’s consistently predicted recessions.) The beginnings of a new round of bailouts for Wall Street actually started in September 2019, four months before the first known COVID-related death in China. And by the time the coronavirus pandemic was declared in March 2020, the global economy found itself at the end of a long debt cycle, a crisis compounded by decades of neoliberal policies and their amplification (“austerity”) after the Great Recession.

Without the coronavirus, then, a global crisis of capitalism would almost certainly still have occurred, whatever the immediate precipitating event that set it in motion. But COVID has powerfully intensified capitalism’s pre-existing contradictions, especially with respect to both corporate and household debt, whilst unleashing a severe health crisis on workers whose working conditions were already under assault by employers facing profitability problems.

This has been especially true for Canadian capitalism.

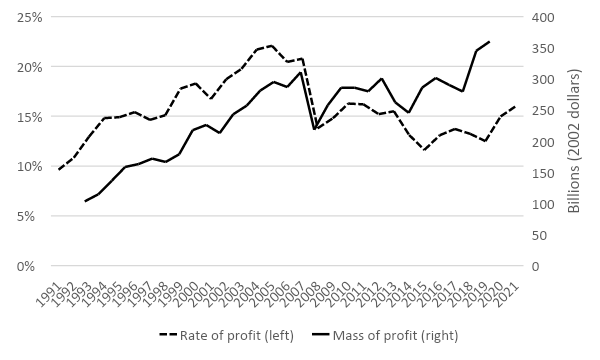

Although the trajectory of the rate and mass of profit in Canada broadly follows global trends, it doesn’t move in precisely the same way and with the same rhythms. In Canada, the rate of profit continued to fall after 1982 and into the Great Canadian Slump of 1990-92. It was only thereafter that the fortunes of Canadian capital were reversed (Figure 2). A significant spike in bankruptcies cleansed the system of the most uncompetitive capital, freeing up market space for the survivors, and increasing the “reserve army of labour” – that is, unemployed workers. This was also the period when capital and the Canadian state, at both the federal and provincial levels, aggressively implemented neoliberal social policies and re-engineered the labour market to increase worker vulnerability. Cuts to welfare state programs like unemployment insurance and welfare supports, which had previously offered a modest alternative to complete dependency on the market for survival, forced increasingly desperate workers to accept worsening working conditions, while employers adopted more advanced cost-saving technologies and systems of labour control. Together, these changes led to a sharp increase in the rate of labour productivity – above that of wages. In Marxist terms, capital was able to raise the rate of exploitation, i.e. pump even more value out of workers relative to wages, ushering in a sustained period (or “long wave”) of profitability and strengthened capital accumulation that lasted from 1993 to 2005.

Figure 2 – Rate & mass of profit, Canada

Sources: StatsCan Tables 36-10-0103-01 and 36-10-0097-01, authors’ calculations

In 2006, profits started to falter again when the long wave of growth and stability came to an end, as such periods inevitably do. Compelled by the imperative of market competition, the organic composition of capital (the value of “dead” labour, i.e. machines, tools, and infrastructure, relative to that of “living” labour) grew sharply: capitalist investment in machines, tools, and infrastructure began to outpace growth in labour productivity. The rate of exploitation slowed, i.e. the amount of value squeezed out of workers relative to their wages declined, which inevitably weighed on the rate of profit. But owing to the destructive impact of the early 1990s recession on Canadian capital and the relatively late restoration of profitability in Canada compared to the U.S. and Europe, by the mid-2000s the profitability of capital hadn’t stagnated in Canada to the same degree as in those places. The balance sheets of businesses and households were still strong enough to withstand the financial crisis of 2007 in a way that many countries couldn’t. From that time until the pandemic, however, Canadian profitability was lacklustre, Canada’s economy was stagnant, and its businesses and households accumulated large amounts of debt. Canadian banks’ debt-to-equity ratios – a measure of how much a company’s growth is financed with debt, rather than with its own reinvested profits – were amongst the highest in the world. Even before the pandemic started, stagnating wages and growing household debt left many families within $200 of insolvency every month, threatening Canada’s financial system.

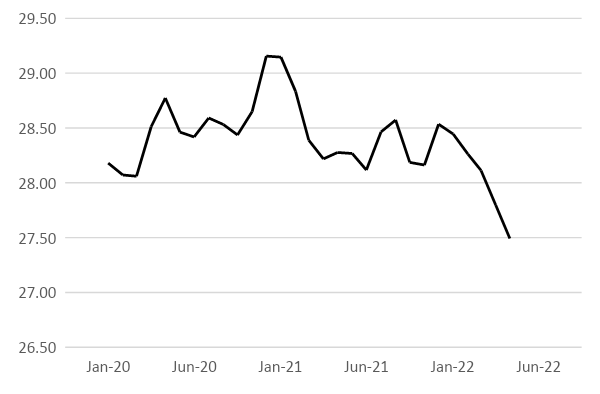

As can be seen above in Figure 2, there was an improvement in profitability in Canada during the pandemic, in 2020-21. A temporary surge in labour productivity in 2020 – since subsided, and discussed in more detail below – accounts for some of these gains. In 2021, it seems profits recovered by cutting into real wages, i.e. wages adjust for inflation (Figure 3). While the data for the current year are not yet available, the drop in real wages may have buoyed profitability in 2022 as well.

Figure 3 – Real wages

Sources: StatsCan Tables 14-10-0209-01 and 18-10-0004-01, authors’ calculations

As Marx notes in his discussion of capitalist crisis, driving down real wages is a strategy deployed by capital to improve profitability. The attempt to depress real wages, by keeping workers’ wage increases well below the rate of inflation, is backed up by ubiquitous warnings from the Bank of Canada and major commercial banks about a potential wage-price spiral, cover for making workers and not businesses shoulder the burden of inflation. If workers’ struggles are unable to win wage increases to make up for inflation, this ruling-class strategy might offer capital some breathing room in the face of looming crisis.

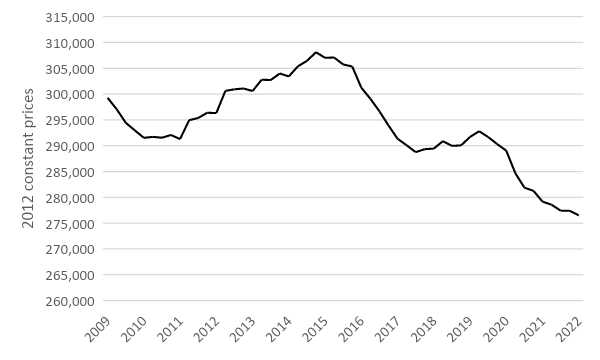

But restoring sustained growth in profitability will likely require even more far-reaching transformations in the Canadian economy, given how profound the contradictions of Canadian capitalism have become. In a telling sign of Canadian capital’s lack of confidence in its own near-term stability, the latest data demonstrate a continuing decline in business investment – that is, in capital accumulation. In capitalist societies, capital accumulation follows profit: an increase in profits, such as occurs during long waves of growth, leads to an increase in purchases of machinery and other equipment, as businesses, confident of strong future returns on investment, seek to expand in search of greater market share. That is clearly not what is happening in Canada now.

While pandemic-related supply chain disruptions have played a role here, the sharp and steady slowdown in non-residential business investment in Canada started much earlier, after the precipitous drop in global oil and gas prices in 2014. Or, more precisely: capital accumulation actually stagnated across much of the Canadian economy after 2008, but this stagnation was obscured – and the overall economy buoyed – by high oil and gas prices until 2014. The value of the country’s stock of machinery and equipment has shrunk by 10 percent since that time (Figure 4). The drop in investment in non-residential business structures has been even more severe still. By early 2022, as Statistics Canada recently noted with concern, investment in both “non-residential structures and machinery and equipment were 4% below pre-COVID-19 levels and 22% below peak levels in 2014.” Meanwhile, the capacity utilization of Canadian industry – how much of Canada’s productive capacity is being used by industry – only just recently recovered to its pre-pandemic level and remains well below its pre-2008 rate. The slowdown in non-residential business investment is expressed in waning labour productivity and capital’s inability to pump higher rates of surplus value out of its labour force. After getting a temporary boost early in the pandemic as lower-productivity sectors were more likely to shut down, we are back at the pre-pandemic norm: labour productivity has been declining again for nearly two years now. It is these dynamics that lie behind the Organization for Economic Co-operation and Development’s projection that Canada is going to have the lowest growth rate among the organization’s members over the next decade.

Figure 4 – Business sector stock of machinery and equipment

Source: StatsCan Table 34-10-0163-01

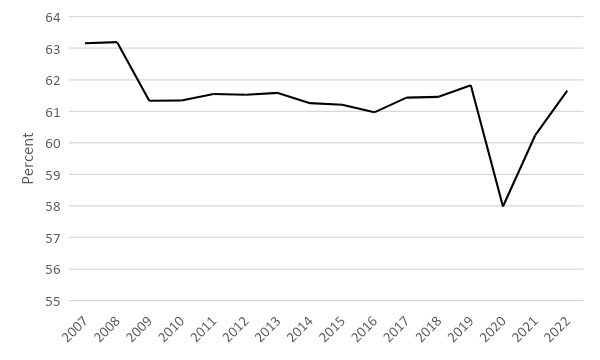

Another indicator of the anemic state of Canadian capitalism is the employment rate. The bourgeois media and politicians are quick to refer to a declining unemployment rate as a sign that things aren’t so bad for workers, and that we need to be vigilant about preventing a potential wage-price spiral. Yet the employment rate is a more useful measure of growth or stagnation in employment. Unlike the unemployment rate, it measures the number of employed persons against the entire labour force, not just against those actively seeking work. While the employment rate had been steadily rising and re-attained its pre-pandemic level in the winter of 2022, this could not be sustained: it declined again this summer, to back below that rate, and has never recovered to its pre-2009 level.

Figure 5 – Employment rate

Source: StatsCan Table 14-10-0287-01, authors’ calculations

The scale of debt accumulated since 2008 also weighs heavily on Canadian capitalism, potentially making profitability even more volatile. For capital, debt is a claim on future surplus value: lenders loan money with the expectation that borrowers will be able to earn enough profit (i.e. surplus value) to pay them back, plus interest. In turn, businesses that take on debt must force their workers to produce enough surplus value not only to reinvest and accumulate, but also to pay back creditors. This puts greater pressure on workers, of course, as employers are further incentivized to try to squeeze ever more productivity gains from labour – through speeding up the pace of work, lengthening workdays, and cutting corners on health and safety – while containing wages.

Before the pandemic, historically low interest rates made it easier for companies to survive in the face of stagnant profitability, particularly companies that were struggling to keep up with more competitive rivals. Post-2008, debt was cheap, and businesses piled it up as a survival strategy in the hopes of holding on until, somehow, their fortunes improved. Pre-pandemic, Canada had the highest rate of so-called “zombie” companies (companies more than ten years old that can’t meet their interest payment obligations) amongst the wealthiest countries in the world, estimated by the Bank of Canada at 25 percent of publicly traded firms. The situation has only worsened since then. Earlier in the pandemic, Canada witnessed the sharpest jump in the advanced capitalist world in overall indebtedness-to-GDP, and by 2021 Canada’s business debt-to-GDP ratio had accelerated dramatically, sitting at a historic high – a fragile situation made more precarious when the state started to wind down its pandemic support programs later that year. Indeed, by the first quarter of 2022, insolvencies in Canada had increased by 33 percent over the same period of the previous year, the biggest such increase in 31 years. Today, as interest rates rise, a deeper reckoning lurks on the horizon. As cheap credit disappears, even more companies will have trouble borrowing or paying off their debts. By raising interest rates, the Canadian state has decided the debt crisis can’t be kicked down the road indefinitely, and is prepared to cleanse the system of poorly performing capital.

Bound up with the growing debt problem, one of the most (if not the most) volatile features of Canadian capitalism leading up to and throughout the pandemic has been the housing bubble, which is a product of a debt-driven real estate boom that has accelerated significantly since 2008. The housing bubble has in fact been the main engine of economic growth in Canada in the post-2008 period, especially after global oil and gas prices declined sharply in 2014. In search of better returns amidst stagnating profitability, investment capital flowed speculatively into a sector buoyed by state policies: low interest rates, for instance, and a permissive regulatory framework designed to stimulate household borrowing. Cheap debt encouraged households to borrow more and thus grow household indebtedness – increasingly disproportionate to incomes – as house prices skyrocketed. Since before the pandemic, uninsured mortgages have grown at a rapid pace, reaching $1 trillion this May, nearly 20 percent higher than the previous year. Such spectacular – and speculative – growth in asset prices, like the earnings investors hope to gain from it in the absence of prospects for higher returns elsewhere, is never stable. And as the financial crisis of 2007 reminds us, the consequences of such a bubble bursting, for heavily indebted households and the wider economy, can be profound.

State intervention throughout the pandemic, such as the income and wage supports discussed above, helped to prop up the housing bubble. Now that that intervention has wound down and the Bank of Canada is raising interest rates, the danger is that these moves will cause a collapse in the housing market, or at least a sharper contraction than the Bank of Canada intends, leading to a situation of steeply declining housing prices and unmanageable debt for an increasing number of households already faced with real wage and savings loss. Although the average household saw its savings grow in the first two years of the pandemic – with the notable exception of the poorest one-fifth of households, who have a negative net savings rate, i.e. they spend more than their disposable income – household savings are down 44 percent in the first quarter of this year compared with the first quarter of the previous year, with the highest rates of decline suffered by those with lower incomes. By July, housing prices were already down six percent from their February high point – the biggest five-month drop since 2009.

When employment levels decline again as the wider capitalist crisis erupts, the hit for households will be that much more brutal. Indeed, the combination of the drop in the value of real estate, the termination of government pandemic supports, and high inflation (food prices, for instance, have increased at their fastest rate in 40 years) has led to the largest quarter-over-quarter decline in household net worth on record. Mortgages, moreover, have been banks’ biggest and fastest-growing asset for the past decade; a major wave of defaults would have serious consequences for those institutions. At the same time, while the Bank of Canada’s interventions might reduce speculative volatility in the real estate sector, they do nothing to address the deeper profitability and accumulation problems in Canadian capitalism as a whole.

The precarious ground on which many companies stand will crumble further as stagnation persists, state-provided pandemic supports fade in the rearview mirror, and interest rates rise. The possibility of stagnation mutating into a full-blown capitalist crisis of a scale not seen in decades, particularly as other advanced capitalist countries themselves are teetering towards potentially major crises of their own, is real – and will amplify the pressures on capital and the state to try to restore economic stability by imposing greater burdens on workers, the poor, and Indigenous peoples.

Indeed, having spent massive sums of money to keep capitalism from collapsing during the pandemic, causing public debt to balloon in the process, the ruling class may choose to avoid another round of significant bailouts – especially for workers, but even perhaps for zombie capital. Having kicked the crisis down the road since before the pandemic, intensifying the contradictions still further, at least some representatives of the ruling class have decided such tactics are no longer sustainable and it’s time to unleash a recession. The possibility of a deep and destructive system-wide crisis, however much the system’s managers hubristically intone about their ability to navigate a “soft landing,” is the risk the ruling class is willing to take to impose a capitalist reboot.

From a human perspective, this is a disaster. A recession will make the lives of workers, the poor, migrants, and Indigenous people significantly worse. But from the perspective of capital, there’s a perverse logic: as noted above, a recession will wipe out the most uncompetitive companies, thus opening up market space for the survivors. Because unemployment relief is so inadequate – notably, the federal government refused to reform employment insurance during the pandemic, instead deploying temporary programs to support those who’d lost jobs – the resulting spike in unemployment will increase working-class desperation, driving down wages and worsening working conditions. The recession is capital’s way of saving itself from itself. And as we’ve seen throughout the pandemic – when the well-being of profits has trumped sensible public health policies and millions have been left to get sick, thousands to die – capital and the state will always place profit over life.

The Canadian state’s role here, as a capitalist state, is to insure that long-elusive capitalist stability is restored, using whatever amount of compulsion is needed. It will likely keep interest rates high as jobs are lost and living standards are eroded, undermine workers’ rights, support the extractive sectors’ export strategies by attacking with renewed vigour Indigenous land defenders and their allies, step up border controls and enforce the legally constituted precarity of cheap migrant labour (the use of which has jumped sharply this year), and clear parks of encampments, among other things. Behind the “free market” is not the hidden hand, but the clenched fist.

At the same time, a severe crisis will also deepen the political volatility unleashed by the pandemic, further opening space for an already-invigorated far right. The far right’s answer to deepening crisis, as witnessed in other parts of the world where its growth is more advanced than in Canada (but foreshadowed already in Canada through the anti-vaccine mandate mobilizations), is to build a street-based movement with a martial politics committed to order and nation, white supremacy, and a radical indifference to public health and workers’ rights. Calls for harsher border controls and more authoritarian measures to restore “order” grow louder amidst economic contractions, and find wider resonance beyond the organized far right.

There are thus serious challenges ahead for socialists, already facing the fight against climate catastrophe and the ongoing devastation of the pandemic. Our tasks are daunting, and we shouldn’t pretend they aren’t, or that the solution to building a mass and militant fight for a better world is waiting for us ready-made, a truth revealed in the distant past, if only more people would just listen to those carrying its message. But we must remind ourselves that as foreboding as things seem today, the future of these crises – those already occurring and those still to come – hasn’t been written. It’s never preordained how crises unfold, how they’re resolved, and upon whose shoulders their burdens ultimately fall. All of that is determined through struggle. Writing during the Great Depression of the 1930s, Marxist theorist Henryk Grossman explained that the objective situation in such periods of crisis is such that capitalism “can no longer secure the living conditions of the population.” In these periods, “the class struggle becomes intensified from and through this objective situation.”

The ruling class is organized and clearly committed to pursuing its dystopian vision for our future: more free markets, dispossession, inequality, carceral violence, militarism, and destruction of nature. It is committed to defending its continued rule at any cost, including the viability of human life on the planet. Defeating its agenda won’t be easy, nor is success assured. But our only hope lies in our dedication to building emancipatory movements with the practical capacities to remake our world.

Todd Gordon is an editor of Midnight Sun. He is co-author, with Jeffery R. Webber, of Blood of Extraction: Canadian Imperialism in Latin America (Fernwood Publishing), and author of Imperialist Canada (ARP Books) and Cops, Crime & Capitalism: The Law-and-Order Agenda (Fernwood Publishing).

Geoffrey McCormack’s writing has appeared in Historical Materialism and Briarpatch Magazine. He is based in Fredericton.

[Top: Photo: Xavi Cabrera/Unsplash]