Articles Menu

Nov. 3, 2022

This essay is dedicated to the memory of Herman Daly, the father of ecological economics, who began writing about the absurdity of perpetual economic growth in the 1970s; Herman died on October 28 at age 84.

Politicians and economists talk glowingly about growth. They want our cities and GDP to grow. Jobs, profits, companies, and industries all should grow; if they don’t, there’s something wrong, and we must identify the problem and fix it. Yet few discuss doubling time, even though it’s an essential concept for understanding growth.

Doubling time helps us grasp the physical meaning of growth—which otherwise appears as an innocuous-looking number denoting the annual rate of change. At 1 percent annual growth, any given quantity doubles in about 70 years; at 2 percent growth, in 35 years; at 7 percent, in 10 years, and so on. Just divide 70 by the annual growth rate and you’ll get a good sense of doubling time. (Why 70? It’s approximately the natural logarithm of 2. But you don’t need to know higher math to do useful doubling-time calculations.)

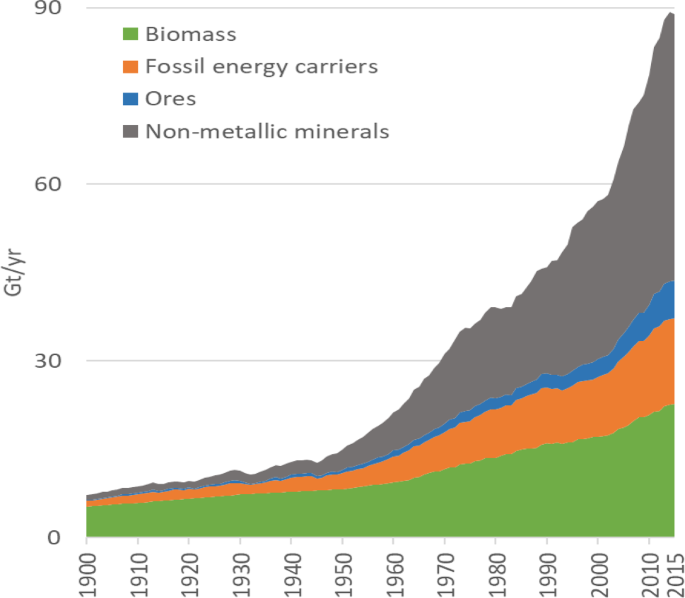

Here’s why failure to think in terms of doubling time gets us into trouble. Most economists seem to believe that a 2 to 3 percent annual rate of growth for economies is healthy and normal. But that implies a doubling time of roughly 25 years. When an economy grows, it uses more physical materials—everything from trees to titanium. Indeed, the global economy has doubled in size in the last quarter-century, and so has total worldwide extraction of materials. Since 1997 we have used over half the non-renewable resources extracted since the origin of humans.

As the economy grows, it also puts out more waste. In the last 25 years, the amount of solid waste produced globally has soared from roughly 3 million tons per day to about 6 million tons per day.

Global materials extraction and usage, 1900 to 2015. Source: Arnulf Grubler, Technological and Societal Changes and Their Impacts on Resource Production and Use.

NOTE: higher res version here: https://ars.els-cdn.com/content/image/1-s2.0-S0959378017313031-gr2_lrg.jpg.

Further, if the economy keeps growing at the recent rate, in the next 25 years we will approximately double the amount of energy and materials we use. And by 50 years from today our energy and materials usage will have doubled again, and will therefore be four times current levels. In a hundred years, we will be using 16 times as much. If this same 2 to 3 percent rate of growth were to persist for a century beyond that, by the year 2222 we’d be using about 250 times the amount of physical resources we do now, and we’d be generating about 250 times as much waste.

Population growth can also be described in terms of doublings. Global human population has doubled three times in the past 200 years, surging from 1 billion in 1820 to 2 billion in 1927, to 4 billion in 1974, to 8 billion today. Its highest rate of growth was in the 1960s, at over 2 percent per year; that rate is now down to 1.1 percent. If growth continues at the current rate, we’ll have about 18 billion people on Earth by the end of this century.

All of this would be fine if we lived on a planet that was itself expanding, doubling its available quantities of minerals, forests, fisheries, and soil every quarter-century, and doubling its ability to absorb industrial wastes. But we don’t. It is essentially the same beautiful but finite planet that was spinning through space long before the origin of humans.

Young people might think of 25 years as a long time. But, given the centuries it takes to regrow a mature forest, or the millennia it takes to produce a few inches of topsoil, or the tens of millions of years it took nature to produce fossil fuels, 25 years is a comparative eyeblink. And in that eyeblink, humanity’s already huge impact on Earth’s finely balanced ecosystems doubles.

Since resources are finite, the doubling of humanity’s rates of extracting them can’t go on forever. Economists try to get around this problem by hypothesizing that economic growth can eventually be decoupled from greater usage of resources. Somehow, according to the hypothesis, GDP (essentially a measure of the amount of money flowing through the economy) will continue to climb, but we’ll spend our additional money on intangible goods instead of products made from physical stuff. So far, however, the evidence shows that decoupling hasn’t occurred in the past and is unlikely to happen in the future. Even cryptocurrencies, seemingly the most ephemeral of goods, turn out to have a huge material footprint.

As long as we continue to pursue growth, we are on track to attempt more doublings of resource extraction and waste dumping. But, at some point, we will come up short. When that final doubling fails, a host of expectations will be dashed. Investment funds will go broke, debt defaults will skyrocket, businesses will declare bankruptcy, jobs will disappear, and politicians will grow hoarse blaming one another for failure to keep the economy expanding. In the worst-case scenario, billions of people could starve and nations could go to war over whatever resources are left.

Nobody wants that to happen. So, of course, it would help to know when the last doubling will begin, so we can adjust our expectations accordingly. Do we have a century or two to think about all of this? Or has the final, ill-fated doubling already started?

Forecasting the Start of the Final Doubling—It’s Hard!

One of the problems with exponential acceleration of consumption is that the warning signs of impending resource scarcity tend to appear very close to the time of actual scarcity. During the final doubling, humanity will be using resources at the highest rates in history—so it will likely seem to most people that everything is going swimmingly, just when the entire human enterprise is being swept toward a waterfall.

Trying to figure out exactly when we’ll go over the falls is hard also because resource estimates are squishy. Take a single mineral resource—copper ore. The US Geological Survey estimates global copper reserves at 870 million metric tons, while annual copper demand is 28 million tons. So, dividing the first number by the second, it’s clear that we have 31 years’ worth of copper left at current rates of extraction. But nobody expects the global rate of copper mining to stay the same for the next 31 years. If the rate of extraction were to grow at 2.5 percent per year, then current reserves would be gone in a mere 22 years.

But that’s a simplistic analysis. Lower grades of copper ore, which are not currently regarded as commercially viable, are plentiful; with added effort and expense those resources could be extracted and processed. Further, there is surely more copper left to be discovered. A key bit of evidence in this regard is the fact that copper reserves have grown in some years, rather than diminishing. (On the other hand, the World Economic Forum has pointed out that the average cost of producing copper has risen by over 300 percent in recent years, while average copper ore grade has dropped by 30 percent.)

What if we were to recycle all the copper we use? Well, we should certainly try. But, disregarding any practical impediments, there’s the harsh reality that, as long as usage rates are growing, we’ll still need new sources of the metal, and the rate at which we’re depleting reserves will increase.

If all else fails, there are other metals that can serve as substitutes for copper. However, those other metals are also subject to depletion, and some of them won’t work as well as copper for specific applications.

Altogether, the situation is complicated enough that a reliable date for “peak copper,” or for when copper shortages will cause serious economic pain, is hard to estimate. This uncertainty, generalized to apply to all natural resources, leads some resource optimists to erroneously conclude that humanity will never face resource scarcity.

Here’s the thing though: if extraction is growing at 3 percent annually for a given resource, any underestimate won’t be off by very many years. That’s due to the power of exponentially growing extraction. For example, let’s say an analyst underestimates unobtanium reserves by half. In other words, there’s twice as much unobtanium in the ground as the analyst predicted. The date of the last bit of unobtanium extraction will only be 25 years later than what was forecast. Underestimating the abundance of a resource by three-quarters implies a run-out date that’s only 50 years too soon.

We’re In It

Resource depletion isn’t the only limit to the continued growth of the human enterprise. Climate change is another threat capable of stopping civilization in its tracks.

Our planet is warming as a result of greenhouse gas emissions—pollutants produced mainly by our energy system. Fossil fuels, the basis of that system, are cheap sources of densely stored energy that have revolutionized society. It’s because of fossil fuels that industrial economies have grown so fast in recent decades. In addition to causing climate change, fossil fuels are also subject to depletion: oilfields and coalmines are typically exhausted in a matter of decades. So, virtually nobody expects that societies will still be powering themselves with coal, oil, or natural gas a century from now; indeed, some experts anticipate fuel supply problems within years.

The main solution to climate change is for society to switch energy sources—to abandon fossil fuels as quickly as possible and replace them with solar and wind power. However, these alternative energy sources require infrastructure (panels, turbines, batteries, expanded grids, and new electrically powered machinery such as electric cars and trucks) that must be constructed using minerals and metals, many of which are rare. Some resource experts doubt that there are sufficient minerals to build an alternative energy system on a scale big enough to replace our current fossil-fueled energy system. Simon Michaux of the Finnish Geological Survey declares flatly that, “Global reserves are not large enough to supply enough metals to build the renewable non-fossil fuels industrial system.” Even if Michaux’s resource estimates are too pessimistic, it is still probably unrealistic to imagine that a renewables-based energy system will be capable of doubling in size even once, much less every 25 years forever more.

So, if another doubling of the global economy is impossible, that means the last doubling is already under way, and perhaps even nearing its conclusion.

It is better to anticipate the final doubling too soon rather than too late, because it will take time to shift expectations away from continuous growth. We’ll have to rethink finance and government planning, rewrite contracts, and perhaps even challenge some of the basic precepts of capitalism. Such a shift might easily require 25 years. Therefore, we should begin—or already should have begun—preparing for the end of growth at the start of the final doubling, at a time when it still appears to many people that energy and resources are abundant.

Re-localize, reduce, repair, and reuse. Build resilience. Become more independent of the monetary economy in any neighborly ways you can.

Teaser photo credit: Today, bitcoin mining companies dedicate facilities to housing and operating large amounts of high-performance mining hardware. By Marco Krohn – Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=40495567

Given the human predilection for growth, these two articles are worth reading also:

“An Inconvenient Apocalypse” Is Not The Feel-Good Book of the Year

We’re On Track For The Global Collapse Predicted By The Club Of Rome In 1972