Articles Menu

Mar. 7, 2024

Despite commitments to align their portfolios with net-zero emissions, Canada’s largest banks are increasingly financing fossil fuel companies and pushing their decarbonization goals out of reach.

According to a new analysis of the portfolios of RBC, TD, Scotiabank, BMO and CIBC from U.K.-based non-profit think tank InfluenceMap, Canada’s big five banks are undermining their own net-zero commitments. With the banks’ annual general meetings set for next month, where shareholders vote on resolutions to shift how the companies do business, the findings provide a fresh look at the growing gulf between rhetoric and action.

The research analyzed US$1.6 trillion worth of bond and equity underwriting deals, as well as corporate lending, at the big five banks in 2020, 2021 and 2022. Over those three years, the banks’ financing of oil and gas companies jumped from US$62 billion in 2020 to US$104 billion in 2022.

Over the three years, InfluenceMap traced 68 per cent of the banks’ oil and gas deals back to Canadian companies.

Banks have a major role to play in Canada’s efforts to curb planet-warming greenhouse gas emissions. By pumping billions into the oil and gas sector at a time when fossil fuels must be steadily phased out, the banks are using their resources to undermine progress made elsewhere in the country, the InfluenceMap report says.

“These banks hold the keys to unlocking the green transition if they commit to using their climate influence and redirecting financial flows from fossil fuels towards clean energy and solutions,” said Catherine McKenna, chair of the UN’s high-level expert group on net-zero commitments and former environment and climate change minister, in a statement. “This would not only help tackle climate change but also create good jobs and increase Canada's global competitiveness.”

According to BloombergNEF, banks should aim for a 4:1 ratio of low-carbon investments to fossil fuel investments by 2030 if the world is going to reach the Paris Agreement’s target of holding global warming to 1.5 C above pre-industrial levels. That goal is the warming threshold identified by scientists and accepted by all countries to avoid dangerous tipping points that will lock in extreme, catastrophic climate damage.

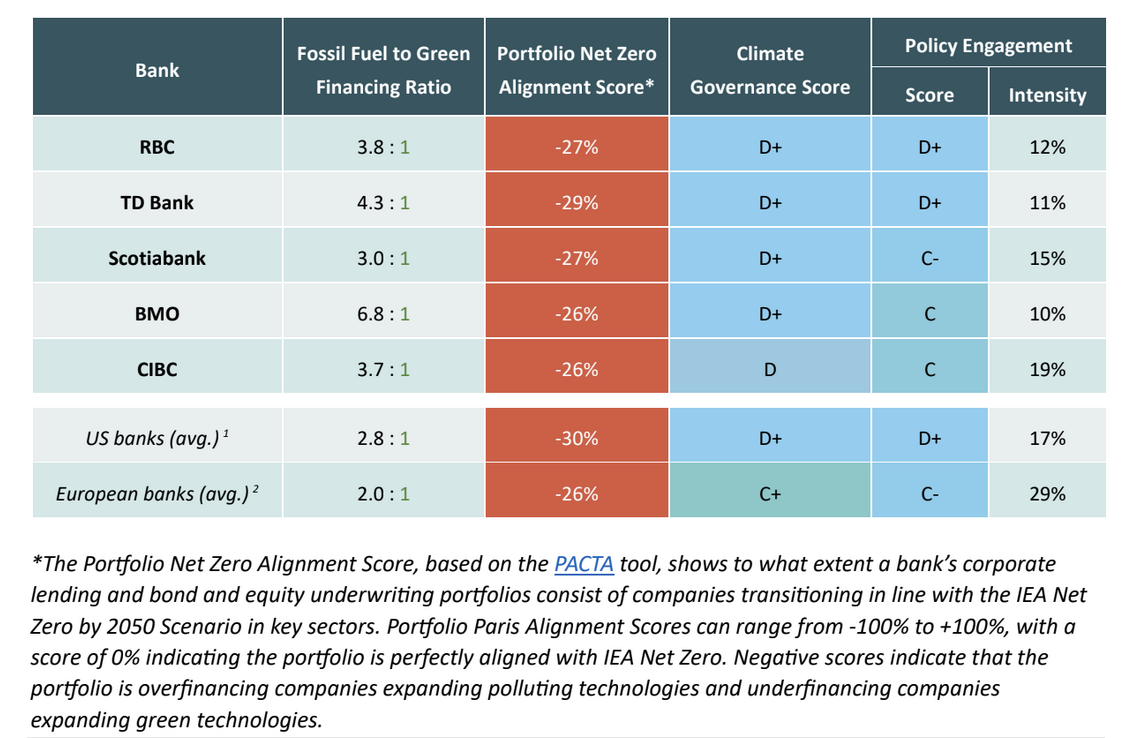

None of the major Canadian banks even come close to meeting that target. In fact, their ratios are entirely flipped, with an average ratio of $3.90 invested in fossil fuels for every $1 invested in green companies.

That puts Canadian banks further behind decarbonization goals than American or European banks, which have an average fossil fuel to clean ratio of 2.8:1 and 2:1, respectively.

"This is why the continued voluntary actions that we're seeing by Canadian banks … is insufficient for where we're at in this moment after experiencing the hottest year on record." #cdnpoli - Twitter

Richard Brooks, Stand.earth climate finance director, told Canada’s National Observer that historically Canadian banks have specialized in energy and mining, and are still known for that expertise. At the same time, the country is “in part a petro-state, where oil and gas companies have inordinate, oversized influence on government policy as it deals with climate issues,” he said.

As a result, Canadian banks are “overexposed” to fossil fuels, Brooks said. On top of that, foreign banks have “stepped away from the financially risky oil and gas sector in Canada because they have read the writing on the wall.”

Brooks pointed to RBC, which published an updated climate plan Wednesday, that he described as “a lot of greenwash.”

RBC’s plan involves allocating $1 billion by 2030 for the development and scaling of “innovative climate solutions,” as well as tripling loans for renewable energy and increasing low-carbon energy lending to $35 billion by 2030.

Brooks said that while $35 billion by 2030 sounds like a lot, the bank recorded $37 billion in fossil fuel lending last year alone. If RBC hits its low-carbon lending target by decade’s end without phasing down its fossil fuels, it would only imply a 1:1 ratio of clean to fossil fuel lending, representing a far cry from what’s required.

“This is why the continued voluntary actions that we're seeing by Canadian banks … is insufficient for where we're at in this moment after experiencing the hottest year on record,” he said. “We have a [federal] budget coming out in April, and that's a key opportunity for Finance Canada to show leadership on this issue, to match where other jurisdictions in the world are going in terms of requiring all companies in Canada to disclose their climate risk and their climate footprints.”

RBC, TD, Scotiabank, BMO and CIBC referred comment to the Canadian Bankers Association (CBA).

The CBA did not comment on whether banks require binding regulation to align their portfolios, but said the banks understand the important role they play in an “orderly transition to a low-carbon future.”

“Firm commitments are required to accelerate clean economic growth and that’s why banks are implementing climate action plans that set specific targets to meet the demands of this global challenge,” the CBA said. “This includes working with clients across industries to help them decarbonize and pursue energy transition opportunities, and financing new and existing green projects that will help Canada meet its net-zero ambitions.

The CBA also took issue with InfluenceMap’s methodology, noting the figures only go up to 2022 and “does not capture the banks’ recent progress on climate-related goals.”

In its report, InfluenceMap described the CBA as an industry group that is “negatively” engaging on sustainable finance issues because it has argued banks will enable the energy transition since they reflect the economy at large.

At a Senate committee meeting, the CBA argued it doesn’t support legislation proposed by Sen. Rosa Galvez, called the Climate Aligned Finance Act, that would require financial institutions to align with Canada’s emission reduction targets.

“While we are broadly supportive of the objective of ensuring that climate risks are properly captured in financial institutions’ risk modelling and that investors are given sufficient information to make informed choices about exposures, this bill will, unfortunately, not accomplish that objective,” CBA senior vice-president Darren Hannah testified.

Advocacy group Environmental Defence said in a statement the CBA, as well as the Business Council of Canada (BCC), another industry group the banks belong to, have both lobbied against climate-safe financial rules. On top of that, the BCC specifically has pushed the federal government to include certain fossil fuels in its sustainable finance taxonomy — a document to guide green and transition-related finance.

“Canadians are being misled,” said Environmental Defence climate finance manager Alex Walker. “Our banks are promoting themselves as climate champions while lobbying against regulations that would accelerate climate action.

“People in Canada deserve banks which stay true to their word and protect our money against the risks of climate change and invest in climate solutions, rather than more fossil fuels.”

[Top: Artwork by Ata Ojani / Canada's National Observer]